- The stablecoins that makeup Curve’s 3pool have seen increased outflows since the hack.

- The demand for CRV continues to fall, putting downward pressure on price.

In the aftermath of Curve’s reentrancy exploit of July 30, 3pool, one of the decentralized exchange’s (DEX) prominent liquidity pools, continue to experience capital flight, research firm Kaiko noted in a recent report.

Source: Kaiko

According to Kaiko, Curve’s 3pool represents one of its “most important sources of liquidity for DAI, USDC, and USDT” and has seen $175 million since the hack.

USDC has seen the most outflows of all the three stablecoins that make up the currency reserves in the pool. Since the exploit, liquidity providers have removed USDC coins worth $125 million from 3pool. DAI comes in second place with outflows that totaled $60 million, “$25mn of which came in just three transactions on July 31,” the report stated.

Regarding Tether’s USDT, Kaiko found that it has remained roughly even in the Curve 3pool, despite the increased removal of the other stablecoins.

According to Kaiko, this suggests that investors are becoming more skittish about USDT. This is because USDT makes up a disproportionate amount of the pool, so a run on USDT could cause the pool to depeg.

The fact that users are incentivized to remove USDT from the Curve 3pool is a sign that they are worried about the stability of USDT. This could lead to further outflows from the pool, which could put downward pressure on the price of USDT.

The total currency reserves in Curve’s 3pool at press time was $3 million. USDT accounted for the largest share of the reserves, with $1.43 million, or 48.20%. USDC was the second-largest reserve, with $423,654, or 14.25%. DAI was the third-largest reserve, with $1.11 million, or 38%.

Source: Curve Finance

CRV continues to dwindle amid increased sell-offs

At press time, CRV exchanged hands at $0.5597. According to CoinMarketCap, the altcoin’s value has plummeted by 32% in the last month.

Source: CoinMarketCap

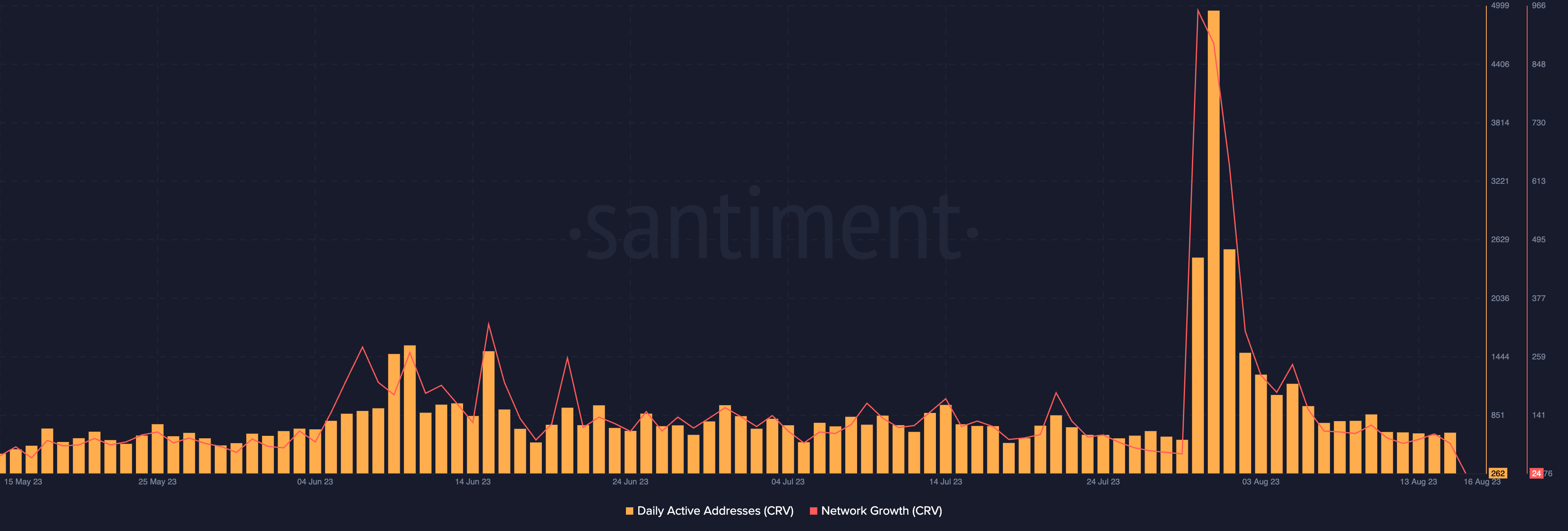

Amid the fear of a complete liquidation of Michael Egorov’s collateral on Aave following the hack, the count of transactions involving CRV has dropped since 30 July. According to Santiment, the count of daily active addresses that trade CRV has declined by 94% since the hack.

Likewise, CRV has failed to draw in new demand as people continue to close their trading positions. Data from Santiment revealed a 90% decrease in the number of new addresses that have been created to trade CRV since the hack.

Source: Santiment