Maker (MKR), the governance token of decentralized finance (DeFi) lender MakerDAO, is nearing its highest price since last May, buoyed by rising protocol profits and accumulation by large investors.

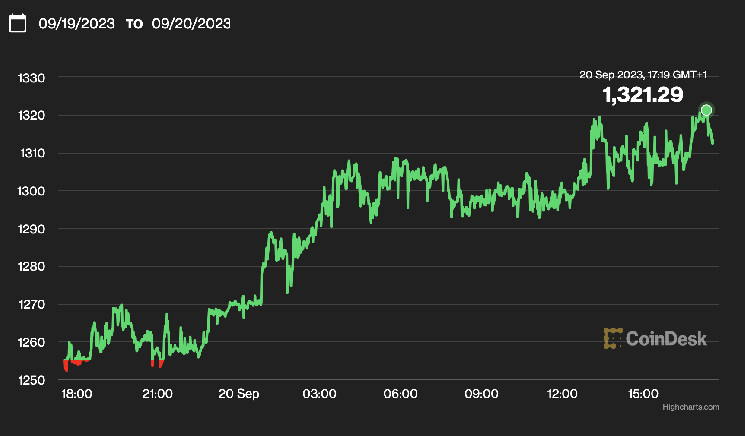

The cryptocurrency rose almost 5% in the past 24 hours to $1,320, approaching its early August high of $1,366, CoinDesk price data shows. Surpassing that level would send the price to a 16-month record.

MKR has vastly outperformed the broader crypto market this year with a 152% return. Bitcoin (BTC) is up 64% over the same period, while the CoinDesk DeFi Index (DCF), which tracks a basket of DeFi tokens, has gained less than 10%.

The surge happened as MakerDAO, which issues the $5.5 billion stablecoin DAI, is increasingly investing its vast reserve assets in U.S. Treasuries, benefitting from the high yields in traditional bond markets.

The protocol’s annual revenue has quadrupled to $185 million since the start of the year, while estimated yearly profit jumped to $58 million from $39 million, according to a Makerburn dashboard. MakerDAO also introduced a 5% reward for DAI last month to spur demand for the stablecoin. Its supply has increased by $1 billion since early August.

Two large crypto investors – also known as whales – have been accumulating MKR this month, blockchain sleuth Lookonchain noted, a sign of improving sentiment towards the crypto asset. One entity bought a total of $1.95 million worth of MKR starting on Sep. 4, while another whale purchased $1.63 million of the token this week.

Crypto hedge fund Ouroboros Capital said the price surge will likely continue due to rising DAI supply and revenues, adding that a bullish technical chart pattern points to a $1,600 price target.

“Nice cup and handle forming in MKR. Still of the view that it will test $1.6K,” the hedge fund said in social media platform X, formerly known as Twitter, post.