Curve founder Michael Egorov has settled his remaining debt position on the decentralized lending platform Aave, according to on-chain data flagged by web3 data analytics provider Lookonchain.

Egorov deposited 68 million CRV ($35.3 million) to the non-custodial lending protocol Silo and borrowed 10.8 million of Curve’s decentralized stablecoin crvUSD over the past two days, Lookonchain posted on X (formerly Twitter). He then swapped crvUSD for Tether’s USDT stablecoin and repaid his entire debt position on Aave today.

Egorov currently has 253.7 million CRV ($132 million) in collateral, securing $42.7 million in remaining debt positions across four other DeFi protocols, Lookonchain added. This includes 17.1 million crvUSD ($17.1 million) on Silo, 13.1 million FRAX ($13.1 million) on Fraxlend, 10 million DOLA ($10 million) on Inverse and $2.5 million in USDC and USDT debt on Cream.

Egorov’s precarious debt positions and OTC deals

In August, Egorov sold 106 million of CRV for $46 million in deals to reduce potential liquidation risks associated with his outstanding debt across the various DeFi platforms, including Aave. Egorov has been working to repay some of this debt to mitigate liquidation risks by selling the CRV tokens for stablecoins.

The token sales included deals with crypto trading firm Wintermute, Tron founder Justin Sun and NFT investor Jeffrey Huang (Machi Big Brother). An anonymous entity secured the largest OTC deal with Egorov, purchasing 17.5 million CRV tokens.

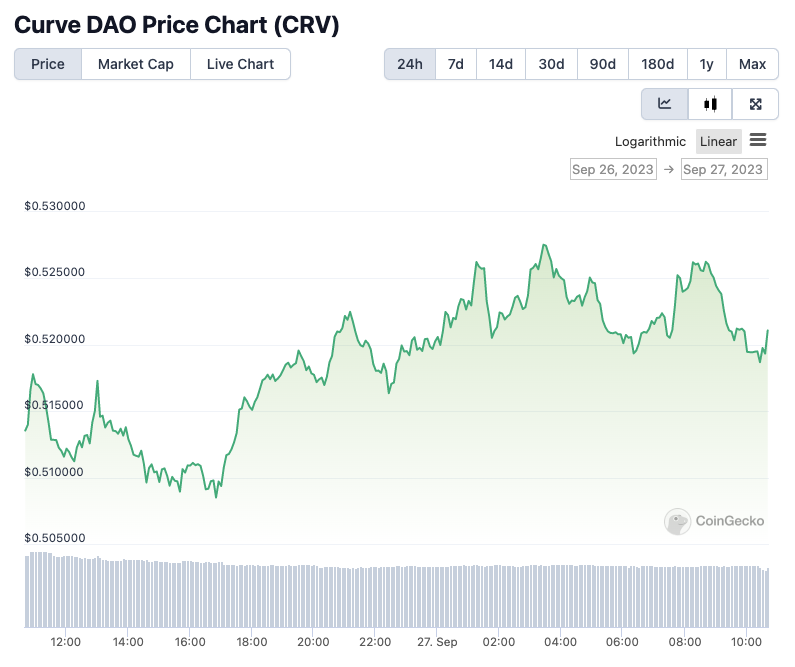

The OTC sales followed a 30% decline in the price of CRV to $0.50 after a security exploit affected multiple Curve Finance liquidity pools in July.

Earlier this month, the price of Curve DAO tokens fell below $0.40 after 609,000 CRV bought over-the-counter from Egorov were transferred to Binance, only to be returned a few hours later.

CRV currently trades at $0.52, according to CoinGecko — up 1% over the last 24 hours.

CRV/USD price chart. Image: CoinGecko.

Disclosure: Wintermute co-founder Evgeny Gaevoy sits on The Block’s board.