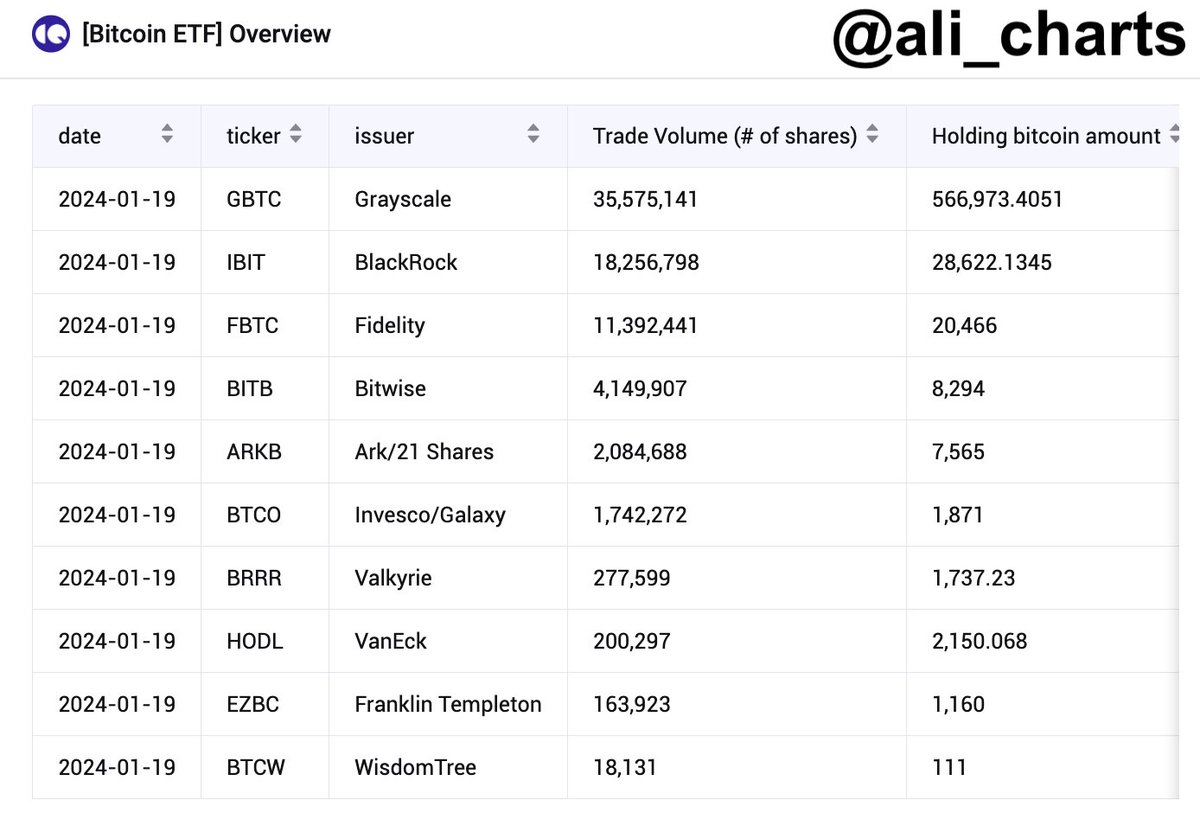

Crypto analyst and trader Ali Martinez says that the recently launched spot Bitcoin (BTC) exchange-traded funds (ETFs) suddenly hold a massive amount of the crypto king.

Martinez tells his 41,600 followers on the social media platform X that the ETF products now hold tens of billions of dollars worth of BTC.

“Bitcoin ETFs in the US now hold over 638,900 BTC, worth around $27 billion [as of Sunday]! Probably nothing.”

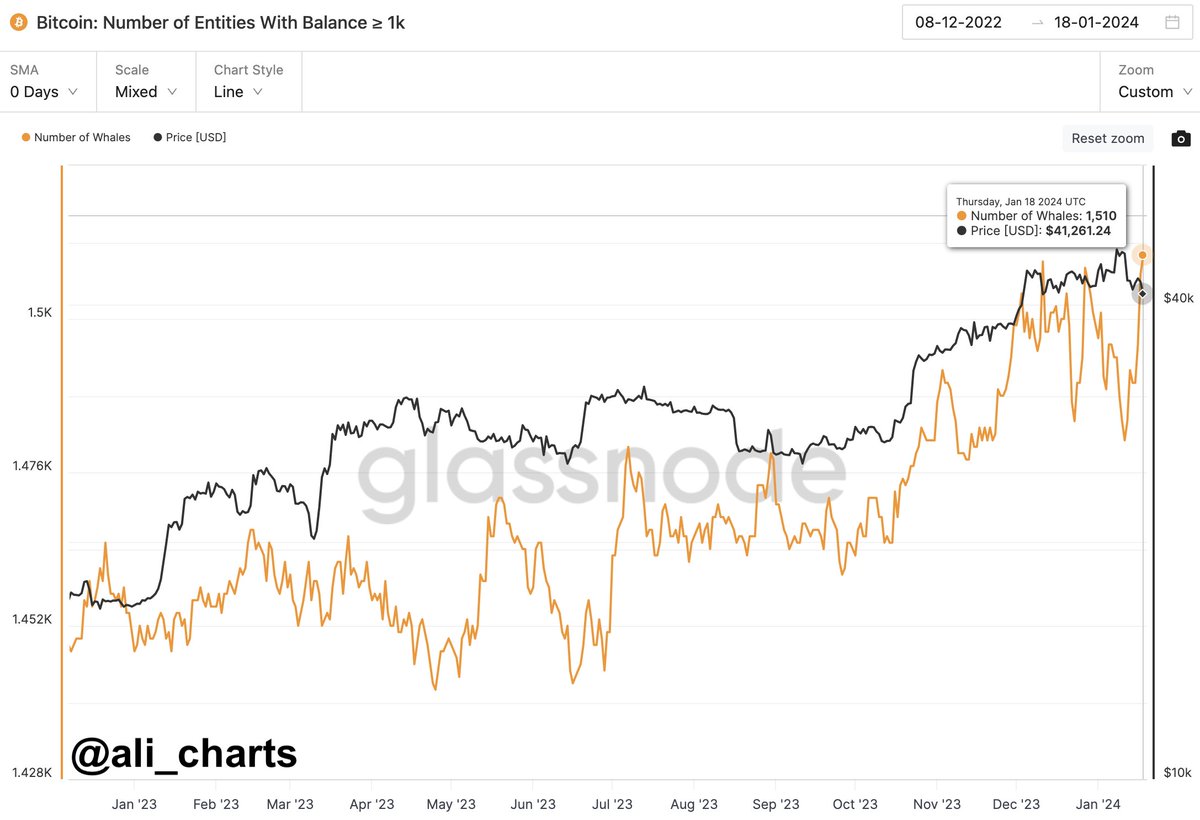

The trader also noticed that on Friday there was an uptick in the number of Bitcoin whales – deep-pocketed investors holding more than 1,000 BTC.

“[January 19th] marks a notable uptick in Bitcoin whales! The number of addresses holding over 1,000 BTC has reached its highest since August 2022, now totaling 1,510 [BTC]. This increase in large BTC holders could signal strong confidence or strategic positioning in the market.”

Bitcoin is trading for $39,893 at time of writing, down more than 4% in the last 24 hours.

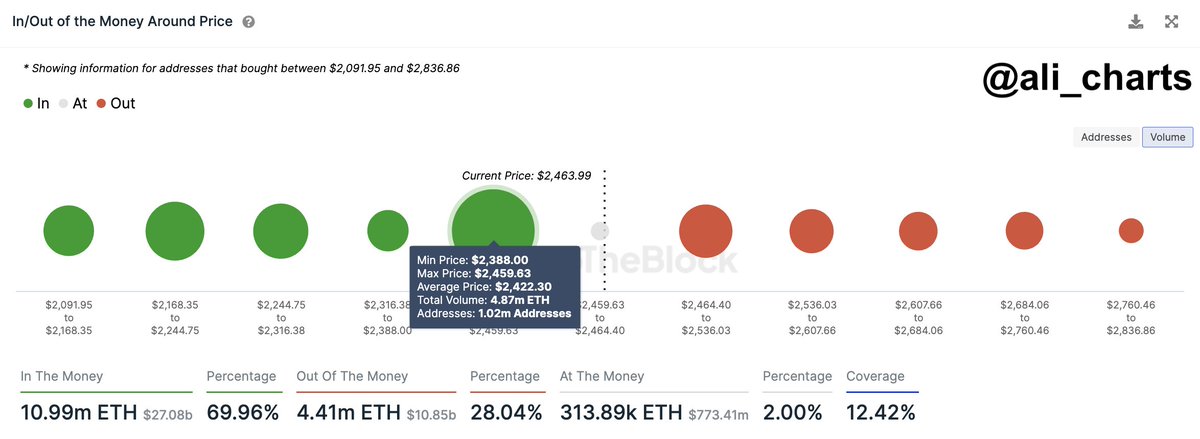

The trader also says that Ethereum (ETH) may be at a critical moment when it could break out or suddenly dip based on the In/Out of the Money Around Price (IOMAP) metric, which attempts to spot key buying and selling areas.

“Ethereum market update: ETH is currently in a key demand zone, ranging between $2,388 and $2,460. If this support holds strong, there’s a clear path ahead with minimal resistance, offering a potential for upward movement.

However, if ETH fails to maintain this level, we might see a pullback to the next significant support area around $2,000.”

Ethereum is trading for $2,325 at time of writing, down nearly 6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney