- Binance topped L1 networks with over 400 million users.

- The TVL was gradually going back to previous highs.

The Binance [BNB] Smart Chain has recently established itself as the leading Layer 1 platform, boasting the highest user count. Its volume has witnessed a notable upswing as well.

What has been the trend for BNB in light of these advancements?

Binance boasts of high unique users

AMBCrypto’s examination of Crypto Rank data, which showed the number of unique users across the top 15 networks, revealed that the BNB chain secured the top position at press time, with 425 million unique users.

Polygon [MATIC] is the only other network that surpassed the 400 million mark.

In contrast, other networks trailed with lower user numbers. At the time of this writing, AMBCrypto’s analysis of unique addresses on its scanner showed over 425.9 million unique users on the BNB chain.

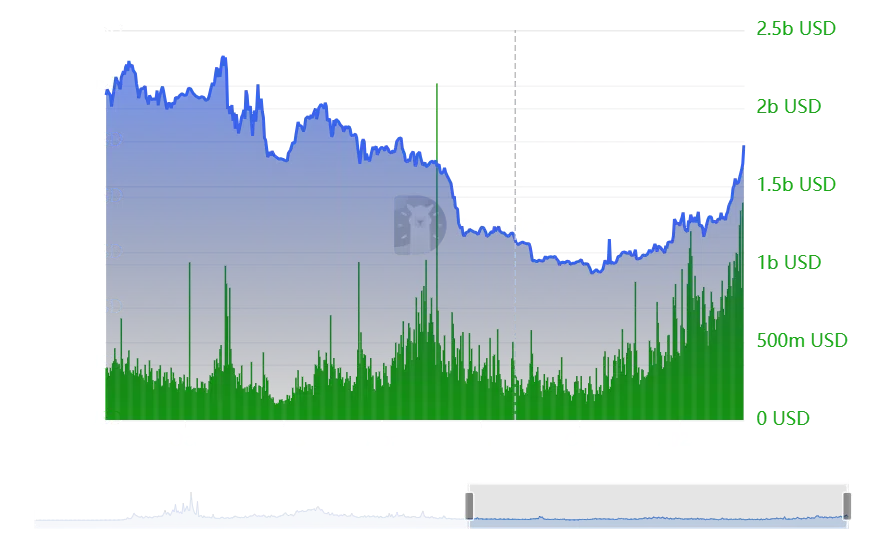

Binance chain sees record volume

AMBCrypto’s further examination showed a surge in volume on the BNB chain on the 28th of February.

The volume metric’s analysis on DefiLlama indicated that, in the preceding days, there has been a consistent trend of volume surpassing $1 billion.

However, on the 28th of February, the volume peaked at almost $1.4 billion. This marked the second-highest volume recorded on the chain in over a year and is the highest volume observed in 2024.

Simultaneously, there has been a noteworthy increase in the Total Value Locked (TVL) within the network over the past few days.

The analysis of TVL indicates that it was approaching a level not seen in almost a year, with the TVL nearing $5 billion at the time of this writing.

It’s important to note that the surge in TVL is attributed to the recent upward trend in BNB.

BNB crosses $400

The recent surge in BNB’s price has been particularly noteworthy in the past few days, reaching levels not seen in months. The coin has entered price regions yet to be witnessed since April 2022.

According to the daily timeframe chart analysis, BNB concluded trading at $415, reflecting a gain of over 5%.

At the time of this writing, there has been a minor decrease of less than 1%, but BNB continued to trade around $414.

Realistic or not, here’s BNB market cap in BTC’s terms

Furthermore, since entering the overbought zone around 20 February, BNB has maintained its position there. The Relative Strength Index (RSI) at the time of this writing was just below 80.

This showed that BNB was not only in a strong bull trend, but was also overbought.