- Interest in the Bitcoin NFT sector dwindled significantly.

- Despite this, the price of BTC surged and activity on the network remained stable.

Despite the halving, Bitcoin[BTC] miners continued to generate large amount of fees over the last few days, signaling ongoing profitability in the mining sector.

The surge in miner revenue was primarily attributed to the emergence of Bitcoin runes, a protocol facilitating the creation of fungible tokens on the Bitcoin blockchain.

The introduction of runes has bolstered mining profitability by opening avenues for the creation of new cryptocurrencies and tokens within the Bitcoin ecosystem.

Trouble ahead

However, recent data suggests a decline in interest surrounding Bitcoin runes, alongside other Ordinal NFTs.

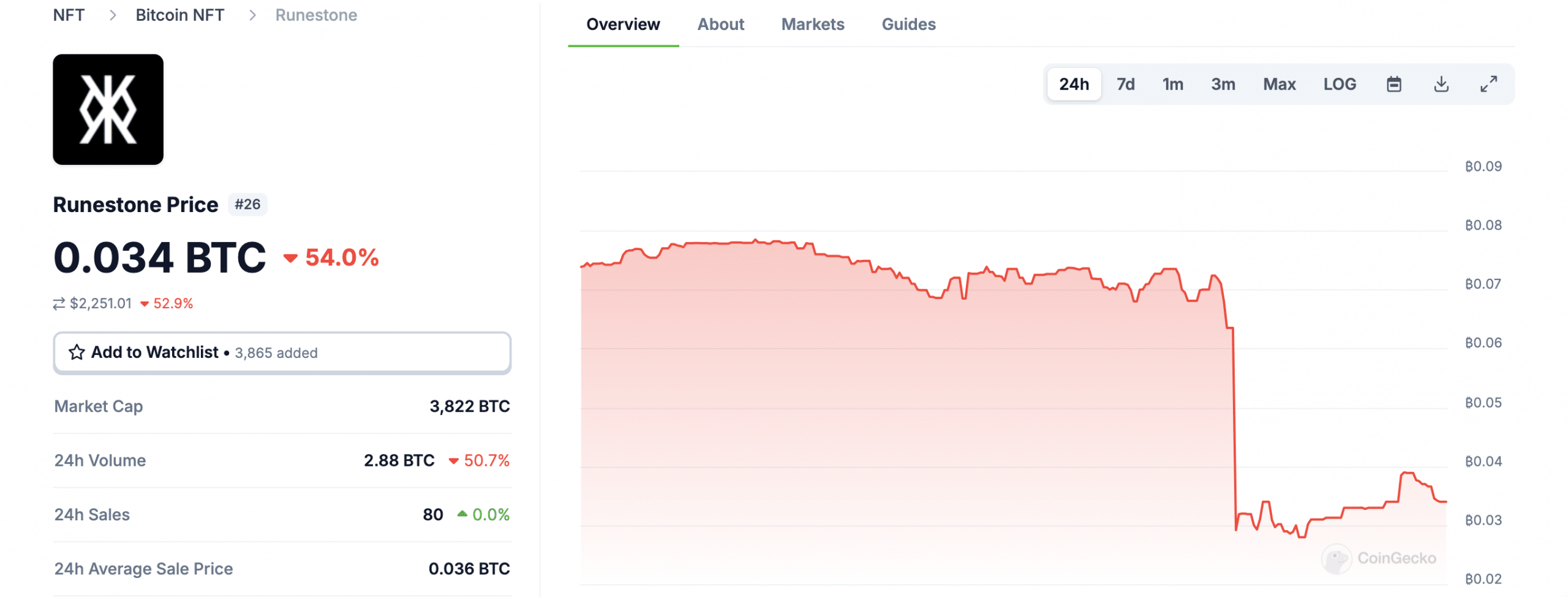

Following the completion of the DOG Runes snapshot at 840,269, the floor price of the Pre-Runes concept Ordinals NFT Runestone plummeted by over 60% within 24 hours.

Conversely, the floor prices of Bitcoin Puppets and NodeMonkes also declined during this period.

Source: Coingecko

This downward trend in interest could potentially impact the fees generated by Bitcoin miners.

With declining enthusiasm for runes and associated NFTs, miners may face increased selling pressure as profitability diminishes, potentially leading to a decrease in overall mining revenue.

Moreover, the repercussions of reduced miner revenue could extend to the broader Bitcoin ecosystem, impacting the cryptocurrency’s price. A decline in mining profitability may trigger selling among miners, contributing to downward pressure on BTC’s price trajectory.

However, there may be a silver lining on the horizon for Bitcoin runes. The recent announcement from Binance regarding a potential listing of runes on its network hints at a possible resurgence in interest.

Such a move by Binance could inject new life into the runes market, reigniting investor enthusiasm and helping BTC’s cause within the NFT space.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

How is BTC doing?

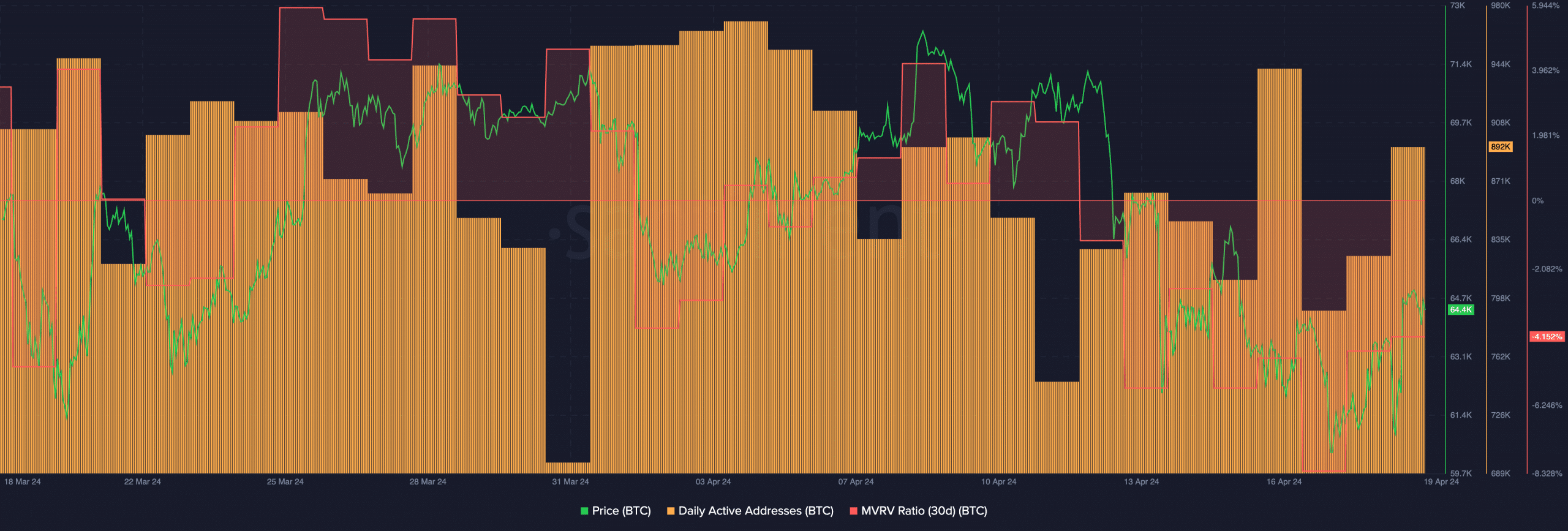

At the time of reporting, BTC was trading at $66,367.49, registering a modest 2.11% increase in the last 24 hours. Despite this price uptick, current activity on the Bitcoin network appears relatively stable, with daily active addresses maintaining consistent levels.

Even though the price of BTC had surged, the MVRV ratio for BTC had declined, indicating that most addresses at the time of writing were not profitable. This suggests that the price of BTC may rally further before significant profit taking begins.

Source: Santiment