Bloomberg Intelligence’s senior macro strategist Mike McGlone says that the second half of the year could be bearish for Bitcoin (BTC) and the rest of the crypto markets.

McGlone says that risk assets, such as stocks and crypto, could get cheap in the coming months as he believes that an economic recession is on the horizon.

According to the macro strategist, the Federal Reserve is still on the path of increasing interest rates, which he notes could negatively impact the performance of Bitcoin and other crypto assets.

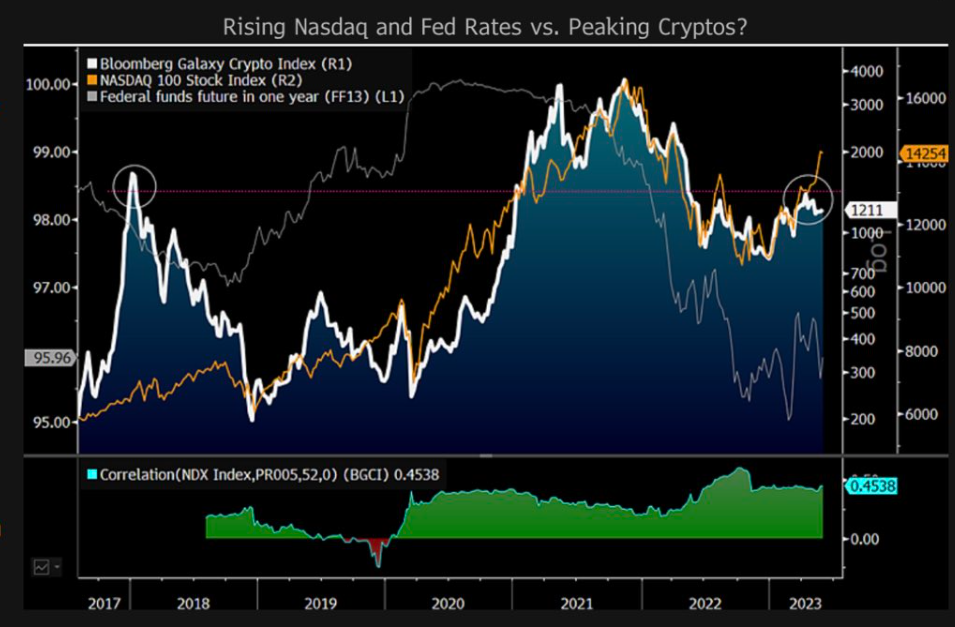

“Risk assets can get cheap in recessions. The cat-and-mouse game between the rallying stock market and watchful central banks could be an obstacle for risk assets. Cryptos are among the riskiest, and the inability of the Bloomberg Galaxy Crypto Index (BGCI) to sustain above its 2018 high in 2023 may be for a good reason: the Fed is still tightening.”

The BGCI tracks the performance of the largest crypto assets traded in USD.

McGlone also says that the Bloomberg Economics team is predicting an “ugly” second half for cryptos and equities

“Our graphic shows a rare divergence, with the Nasdaq 100 Stock Index breaking higher and the BGCI falling in (Q2).

Federal funds futures in one year (FF13) are a liquidity gauge, adding rising rate-hike expectations to a climbing stock market may put a ceiling on crypto prices.

The BGCI has rallied in 2023 by about 50% to June 1 and the Nasdaq 30%, which may shift the bias toward what’s typical in recessions: risk assets can get cheap.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Tithi Luadthong