DeFi

Real Yield is one of the movements that has lately emerged and been widely discussed, particularly in projects in the area of derivatives and options in DeFi, and particularly in the whitepaper of projects on the Arbitrum’s ecosystem.

As the high-risk, high-return period of decentralized financing comes to an end, a new trend of more lucrative but sustainable initiatives has started to take its place.

Real Yield is currently predicted to help DeFi recover and maybe become the trend of the cryptocurrency industry in 2023. It refers to initiatives that accomplish actual things, make real revenue, and reward users with genuine tokens.

DeFi background in 2021

Seasoned crypto investors have noted that the market moves in cycles. These so-called “bullish” phases often follow Bitcoin’s halving occurrences and frequently result in sky-high prices as new participants are Enticed by hype and promises. The dramatic price rises that define a bull market are often followed by even quicker and sharper drops, and the “bearish” phase is so extensive that only ventures with good fundamentals can survive.

Additionally, each cycle is often linked by several tales – popular stories that seek to characterize the present market structure or speculate on the future one. Although DeFi began in 2018 with the advent of projects like Dharma, MakerDAO, and Compound, it truly took off during the “DeFi summer” of 2020 when Compound introduced COMP tokens for incentives.

The DeFi summer ushered in a time of yield farming mania, with numerous ventures imitating Compound by issuing tokens to pay earnings to users. In the most severe circumstances, liquidity providers have provided unrealistically large five, six, or even seven-figure sums for brief periods of time. This liquidity source mechanism helped launch the fledgling sector but ultimately proved unsustainable. Liquidity on DeFi dried up as people began to leave, and most DeFi currencies fared much worse than ETH during the 2021 bull run.

This initial liquidity mining technique is faulty because it generates an excessive number of protocol native tokens rather than sharing the rewards from the underlying protocol. Sourcing liquidity is crucial for protocols. Nevertheless, adopting this technique is incredibly costly, with some estimates suggesting a cost of roughly $1.25 for every $1 of assured liquidity. However, for stakeholders and liquidity providers, the large nominal returns promised by liquidity providers are misleading since real rewards, as assessed by nominal returns minus inflation, do not exist.

Following the DeFi summer, the crypto industry is now convergent on a new niche. Like most previous portions, it is covered by a new concept: “Real Yield.” The phrase describes schemes that incentivize token ownership and liquidity mining by sharing fee earnings. Real Yield protocols often restore actual value to stakeholders by distributing fees in USDC, ETH, tokens produced by them and brought to market through repurchase or other tokens that have not been self-published.

What is Real Yield?

Real Yield is just the profit after removing inflation, and it is quite comparable to the dividend of a company. You invest money in a DeFi protocol, and the protocol generates income from which they pay you a tiny percentage.

The key distinction between Real Yield and many other events in the DeFi industry so far is in the “Real” component.

As we all know, the cash earned by projects might sometimes be insufficient to balance the project’s token inflation since they reward consumers with incredible quantities. Because of this, we sometimes believe that the project is profitable while, in reality, it is losing money. As a result, we have the following formula to compute Real Yield:

Real Yield = Revenue – Token Emissions

Where Revenue represents the project’s income and Token Emissions is the number of tokens distributed as incentives to users.’

The role of Real Yield

If you engaged in DeFi protocols in the years 2020-2021 to generate money, such as Yield Farming, Staking Pool, and so on, it is fully reasonable that these protocols give an interest rate. How “awful” for the participants.

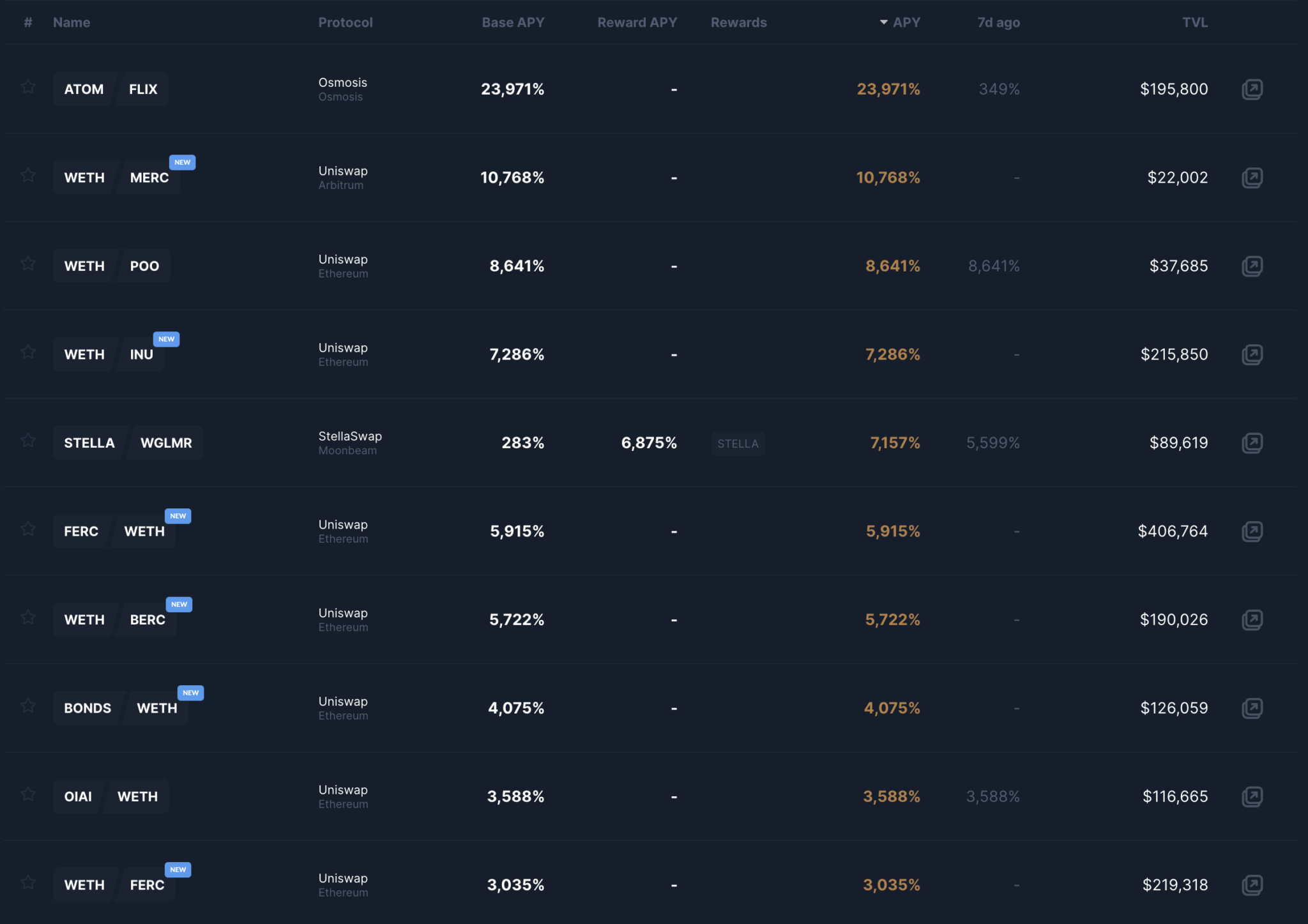

Source: nanoly.com

Looking at the image above, you can readily determine how much fund investors will get after a period of time by using simple arithmetic. In particular, as more individuals join in farming, the APR and APY levels will fall, with the last participants bearing the brunt of the “loss.”

Yet for Real Yield, the enterprises will concentrate on how to earn from their goods rather than just producing and distributing tokens. Generating long-term revenues will enable the project to flourish steadily and not get inflated like Soaring high and then plummet into nothingness.

What does a sustainable Real Yield need?

Hacking assaults, rug pull, token inflation, price drops, and items with limited application come to mind when most people think about DeFi.

Yet, the Real Yield movement provides investors with a unique viewpoint on the decentralized financial market, which differs from the conventional financial market – TradFi (Traditional Finance). Projects must specifically meet the requirements listed below:

- There are obvious results.

- There are clear uses.

- The initiative must create income (the most important factor).

Why the three elements mentioned above?

Conventional DeFi protocols would largely entice users with extremely high APR, and APY levels, but the inclination of users to obtain incentives will instantly sell stablecoins or other assets, thus creating a significant selling force on the project’s token.

To “compensate” for market inflation, the project must produce more diverse income streams from protocol activities.

As a result, the project must develop a more diverse income stream from protocol operations to “compensate” for the market’s degree of inflation. Real Yield differs from standard Yield in that it is “Real,” which is why any project that produces a lot of actual money from their protocol is Real Yield. Following are some of the most typical ways that protocols benefit from their operations:

- Uniswap, SushiSwap, Curve, 1inch, Balancer, PancakeSwap, Trader Joe, Osmosis, QuickSwap, and SpookySwap are DEX brands. The true yield in this scenario is the charge the user must pay for each transaction.

- NFT marketplace: NFT Trading Fee, License Fee on OpenSea, and LooksRare is genuine yield.

- Derivatives: dYdX, GMX, and Synthetix: closure, opening, holding, and liquidation costs are actual yield.

- Lending/Borrowing: Aave, Compound, MakerDAO, and TrueFi: Spread between lending and borrowing rates

- Infrastructure: Filecoin, Helium, Arweave, and The Graph: Renting data storage resources, giving data, and data search costs.

Basic elements of a profitable project

Transaction fee

Certainly, transaction fees are a significant source of income for DeFi-active projects. Every time a user buys/sells a coin/token/nft, they must pay a transaction fee to the platform.

Lending fee

Borrowers who use lending platforms like Aave, Compound, and others must pay an interest rate/fee to both the platform and the lenders.

Not every project with strong income has a Real Yield; the key to Real Yield is profit before inflation. If the income is 5% and the project’s token inflation is 5%, the Yield here is 0%.

How to find “Real” projects?

To assess the true profit in DeFi, you may combine two tools: Token Terminal and Messari.

- Step 1: See the project’s total income and protocol revenue in the Token Terminal. Choose “Metrics” from the website’s homepage, then “Protocol Revenue,” and then search for the protocol you wish to investigate.

- Step 2: Determine the project’s token distribution using Messari. Navigation will lead you to the profile for a specific token, where you may pick “Token Economics” and then “Supply Schedule.” If Messari does not give this information, utilize CoinGecko or Dune Analytics as a substitute.

- Step 3: Check the Revenue found on Terminal with its Emissions found on Messari. Remember to multiply the Emissions value by the token’s price to get the total worth of its Emissions for staking.

After that, you compute using the following formula:

Revenue – Token Emissions = Real Yield

Remember that this approach is not totally accurate since it does not disclose the overhead of a specific project. It will, however, offer you an idea of how reliant a project is on releasing tokens for income.

After you feel that you have identified a protocol that shows promising numbers, make sure that the protocol has the following:

- Product/Market: Everyone must have a fundamental desire to use the protocol, regardless of market conditions or Token Incentives.

- Must-Have Onchain Revenue: If the protocol doesn’t generate revenue, it’s not real profit. Make sure this revenue surpasses Token Emissions + operating costs. Only if revenue is generated, the project can develop sustainably.

- Profit should be paid in bluechip coins: A Defi project that meets Real Yield standards is when it pays profits to users in valuable tokens/coins like BTC, ETH, or in stablecoins like USDC or BUSC. Not paying completely with the token that the project issued.

Having a clear roadmap: A project with Real Yield is not necessarily good, and vice versa – a project without Real Yield is not necessarily a poor quality project, it is important that a project has a roadmap to use Yield from clear emissions. clear.

In addition, you also need to remember that revenue, profit, and value for users are 2 separate issues. Since many projects generate revenue, profits are high but do not share that portion of revenue with token holders.

Conclusion

Although the phrase Real Yield may have struck a chord, it is important to stress that this liquidity source strategy is far from flawless. Secondly, protocols must be lucrative in order to provide value to stakeholders, hence it is ineffective for new projects with few users. To compete and attract adequate liquidity and trade volume, protocols in the initial phase must still resort to inflationary liquidity mining. Additionally, if protocols must turn over their earnings to liquidity providers or token holders, they will have less money for R&D. In the long term, this may have an impact on certain projects.

We might all be “overshadowed” by the enthusiasm in the uptrend market, but when we look around, we all see possibilities.

Yet, until the market enters the downtrend season, all hopes are dashed by “ghost” projects that do not create actual income or serve just to confuse investors.

Real Yield comes as a new criterion that allows us to quickly determine whether DeFi initiatives are excellent. As the market expands, new and tighter rules will be implemented to ensure that the crypto industry’s shared future becomes more and more dazzling.

Real returns or not, history has repeatedly proved that when markets are down and liquidity is scarce, only the protocols with the strongest fundamentals and appropriate for productive markets survive. Only the greatest items make it.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.