Recently, Binance entered Real World Asset (RWA), leading DeFi protocols like MakerDAO and Aave, traditional financial institutions represented by Goldman Sachs, Hamilton Lane, Siemens, and more. A number of US on-chain debt protocols have also begun to roll out aggressively.

Friendly Government agencies are also experimenting with this new field, and Hong Kong is also looking forward to the development of RWA, which will bring the silent RWA back into the public eye.

What are Real World Assets (RWA) in Cryptocurrency?

Real world assets (RWA) are physical assets that enter the blockchain through tokens. These assets can be any form of physical asset, such as real estate, stocks, bonds, commodities, artwork, etc.

Cryptography on the blockchain can make these assets easier to circulate, trade, and fund and can increase their transparency, liquidity, and value.

Obviously, real world assets are huge in the traditional financial industry. However, these assets are barely mined in the DeFi world. This brings real-world assets to the DeFi industry, increasing liquidity availability and providing a new asset class for DeFi participants to leverage for a return on investment. Also, with real-world assets, the return on investment may be less affected by the volatility of cryptocurrencies.

Currently, RWA has 3 main applications in DeFi:

Why is RWA attractive?

The defi market goes downhill

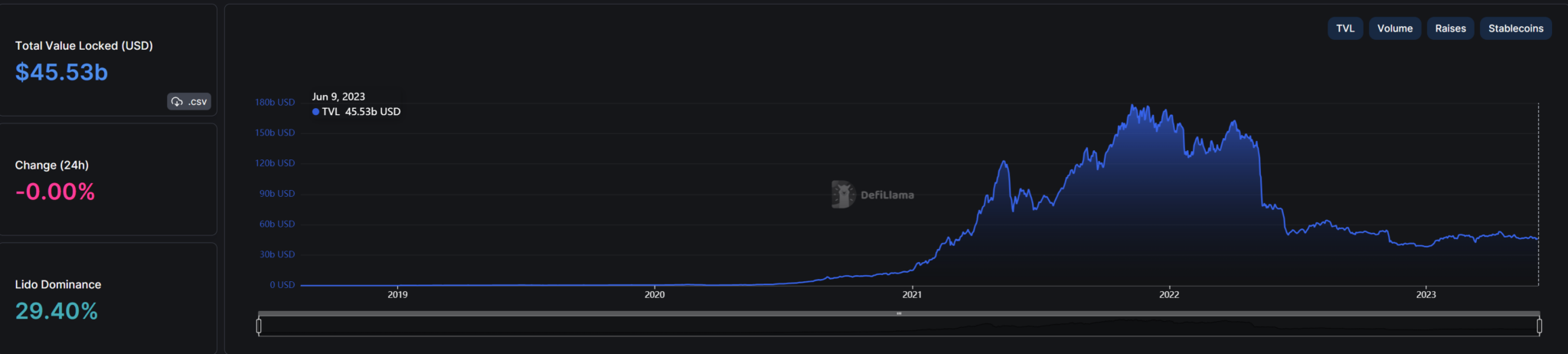

The DeFi market has been thriving since the beginning of 2020 and will reach the TVL milestone of more than $180 billion by the end of 2021. Since then, along with the market downtrend, the value of assets locked (TVL) on DeFi protocols dropped sharply to less than $50 billion.

Source: DefiLlama

As a pillar of technological progress and the driving force of the entire blockchain industry today, however, DeFi still needs to work on better tokenomics models with a high token inflation rate.

Some tokens lost more than 90% of their value and even disappeared from the market, leading to a significant reduction in profits for users. The yield from DeFi is now only equivalent to TradFi (Traditional Finance – traditional finance).

It is easy to see that TradeFi offers a much less risky investment model than DeFi. So when the interest rates between the two arrays are the same, DeFi users will gradually withdraw and return to TradeFi. This situation requires a new source of yields to revive DeFi, and Real World Assets are the answer.

New motivation from RWA

Currently, Real World Assets are contributing a considerable part to the value of global finance. Of which, the debt market (with fixed cash flow) is already worth about $127 trillion, the real estate market is worth about $362 trillion, and the gold market capitalization is about $11 trillion.

Meanwhile, with TVL at just $50 billion, the DeFi market is like a tiny person compared to RWA’s capitalization. If RWA is put on the blockchain, the DeFi market will receive a richer stream of assets with more diverse profit models, thereby driving growth.

The giants have also begun to explore RWA

The Hong Kong Monetary Authority also mentioned in the Hong Kong Digital Dollar Pilot Program announced this month that 16 selected companies from the finance, payments, and technology sectors will conduct a test round first experiment this year to conduct in-depth research on potential use cases of the Digital Hong Kong Dollar in six areas, including comprehensive payments, programmable payments, offline payments, encrypted deposits, third generation Internet transaction payments (Web3) and encrypted asset payments.

In fact, in February of this year, the Hong Kong Special Administrative Region government successfully issued HK$800 million in tokenized green bonds. This is the world’s first tokenized green bond issued by the government.

Meanwhile, financial giants’ exploration and new plans related to RWA tokens are also getting started. Among them, financial institutions such as JP Morgan Chase, Goldman Sachs, DBS Bank, UBS, Santander Bank, Société Générale, Hamilton Lane have entered the actual battle/measurement phase from the research and exploration stage. , Temasek, HSBC, BlackRock, etc., .and other facilities are still in the exploration and preparation stage.

In recent years, some central banks in China have also applied blockchain technology in the fields of supply chain finance, trade finance, and payments and released related platforms such as blockchain trade finance platform, asset securitization platform, and Internet e-commerce financing system…, and more are used to transform and improve the efficiency of financial services digitally.

DeFi opens up huge potential for RWA

Not only is the beneficiary of Real World Assets, but DeFi also helps to create a more efficient market model, especially in the context of TradFi’s performance being gradually saturated.

TradeFi has had to depend on an intermediary system since its inception. The intermediary system includes brokers, identity verification operations, and regulations. This system has partly ensured the safety of transactions, but it comes with limitations on capital efficiency.

According to the International Monetary Fund’s Global Financial Stability Report 2022, TradFi could be more efficient because market participants have to pay fees to intermediaries (including labor and system management fees).

In addition, a third party also controls user assets, and sometimes users are even blocked from the system. DeFi models will help remove these limitations.

Besides eliminating the intermediary system, applying DeFi to RWA makes it easier for users to diversify their portfolios through tokens. Liquidity is also quick with AMM models that help users to complete trades instantly.

This is a massive benefit for those who are familiar with stock trading. Stock investors often have to contact a brokerage company to trade, and transactions are often delayed (such as T+1, T+3).

One final benefit of DeFi for RWA is the transparency of the blockchain ledger, allowing users to observe the flow of transactions, thereby assessing the market situation. This information is often hidden in TradeFi.

Conclusion

Real World Assets are real-world assets on the blockchain to create new assets for DeFi. DeFi also helps RWA owners optimize capital efficiency compared to TradFi. Some prominent uses of RWA in DeFi are stablecoins, synthetic tokens, and lending. These are just simple applications, so this field has much potential for future growth.

However, it is also important to note some challenges RWA faces, such as valuation and authentication issues for assets. When digging deeper, Real World Assets is facing many barriers. Real-world assets have not yet been deeply applied but only as loan collateral. In the coming time, the RWAs segment needs more legal support to develop. This is the most significant barrier and also the bottleneck for the remaining segments to be quickly approved.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.