The round was led by Founders Fund, a venture capital firm co-founded by Peter Thiel, and also included Pantera Capital, Binance Labs, Coinbase Ventures, and Apollo Crypto. These investors have high hopes for the future of Maverick Protocol, which plans to utilize its new capital to develop more efficient liquid staking token infrastructure and address cross-chain liquidity inefficiencies.

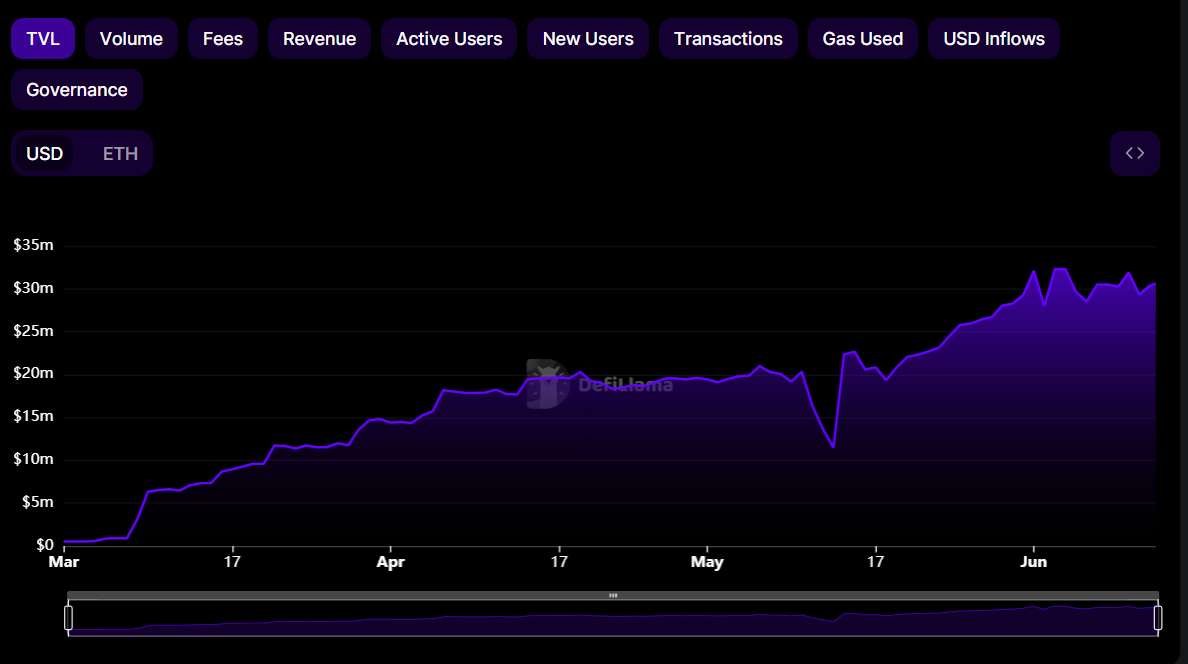

The concept of liquid staking protocols, which allow investors to earn rewards on their tokens without locking them up for a long period, has been growing in popularity. Experts have predicted that this sector will continue to expand following Ethereum’s Shanghai upgrade. Maverick Protocol aims to provide the necessary infrastructure to enhance the efficiency of decentralized finance (DeFi) markets, according to the company’s statement. To date, the protocol has accumulated over $30 million in total value locked (TVL), according to DeFiLlama.

In March of this year, Maverick Protocol launched its decentralized exchange (DEX) on Ethereum, which is powered by a smart contract-based automated market maker (AMM). This enables investors to increase their revenue through automating the ranges in which they put their tokens to work. Since then, Maverick has also collaborated with liquid staking projects such as Lido, Frax, Liquity, cbETH, Rocket Pool, and Swell, the statement said.

As concerns about the stability of centralized exchanges continue to grow, decentralized trading platforms are becoming increasingly popular among traders. The collapse of FTX last year and the recent regulatory backlash against Coinbase and Binance have highlighted the risks associated with centralized exchanges. Traders may, therefore, shift their focus towards platforms that are not dependent on individual large companies and are less vulnerable to sudden market fluctuations.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.