Bitcoin (BTC) experienced a “flash-pump” to $138,000 on Binance.US during early trading hours of June 21, according to data from the crypto exchange.

The Bitcoin price spike lasted only seconds before returning to its normal level and was specific to the exchange’s BTC/USDT trading pair, while other assets continued trading at their usual levels.

Low market depth

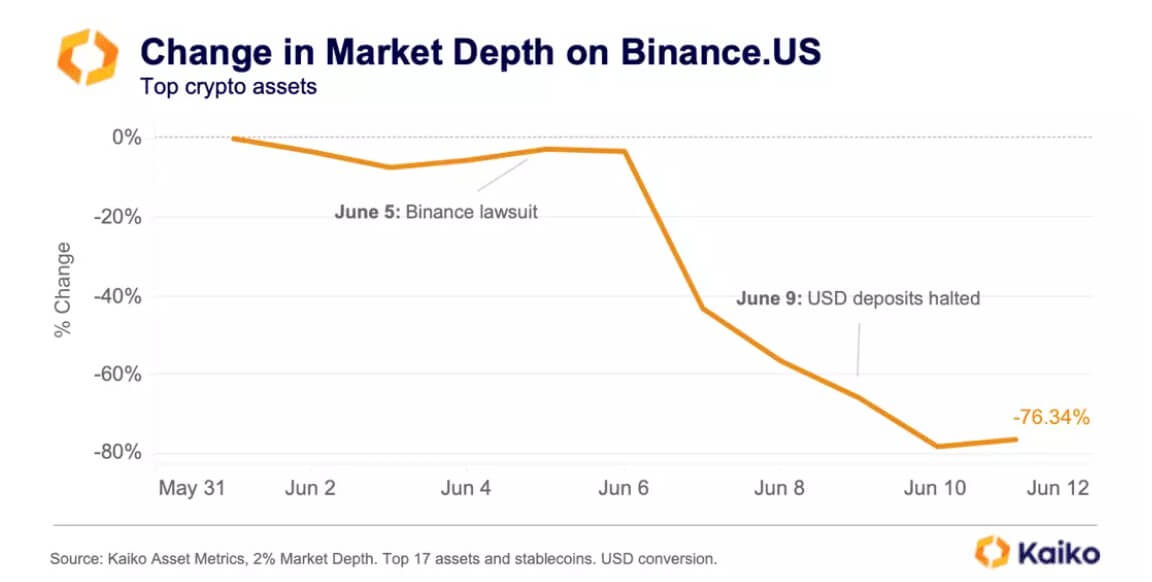

Since the U.S. Securities and Exchange Commission filed its lawsuit against Binance.US on June 5, market makers and traders have fled the exchange due to concerns about potential asset lock-ups.

Blockchain analytical firm Kaiko reported that the exchange’s market depth fell by almost 80% as of June 12, with its market depth for 17 tokens dropping to $7 million from the $34 million recorded on June 4—a day before the SEC’s lawsuit.

At the time, Kaiko said:

“[Binance US] market makers are nervous and want to avoid volatility-induced losses and the non-negligible possibility that their assets could get stuck on an exchange à la FTX collapse.”

Additionally, the exchange’s liquidity issue has been exacerbated by its banking partners’ decision to halt their USD payment channels. In May, Bitcoin traded at nearly a 3% discount on Binance US compared to other rival exchanges.

Binance.US market share plunges

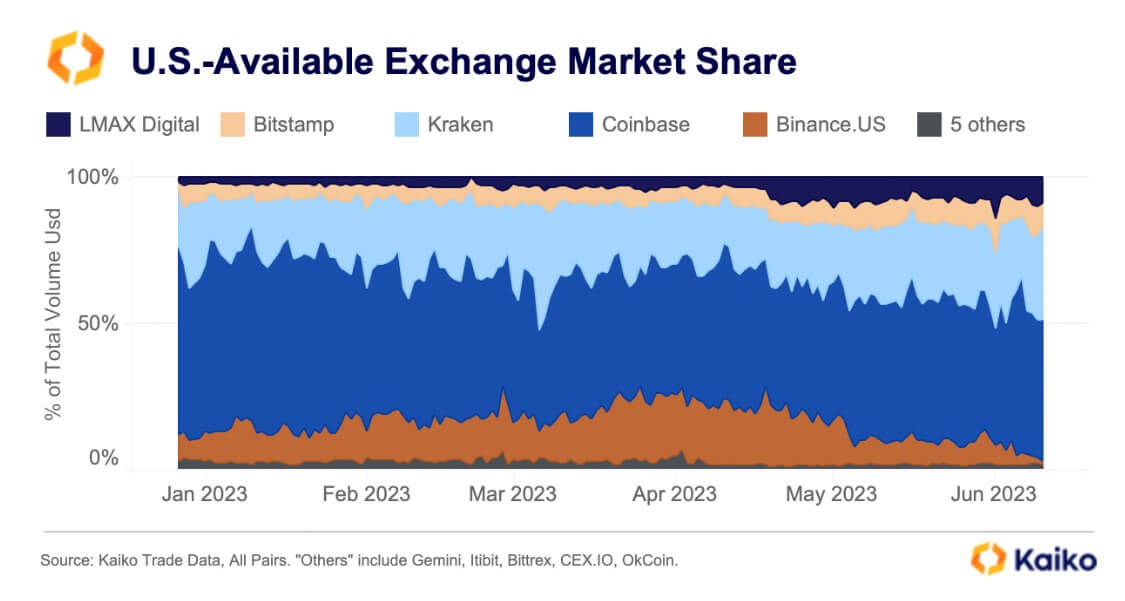

The embattled crypto exchange market share in relation to other U.S.-based platforms has dropped to 1%, according to Kaiko data.

Kaiko noted that this was significantly lower than its all-time high of 27% recorded a few months ago, adding that “the exchange’s reputation has been severely harmed” by the lawsuit filed against it by the SEC.

While the Court rejected the SEC’s attempt to freeze its assets, the exchange has had to deal with other issues, including the layoff of about 50 staff members across several departments.

Meanwhile, Binance US has maintained that it would fight the SEC’s allegations in Court.

The post Bitcoin price briefly pumps to $138,000 on Binance.US amid exchange’s liquidity crisis appeared first on CryptoSlate.