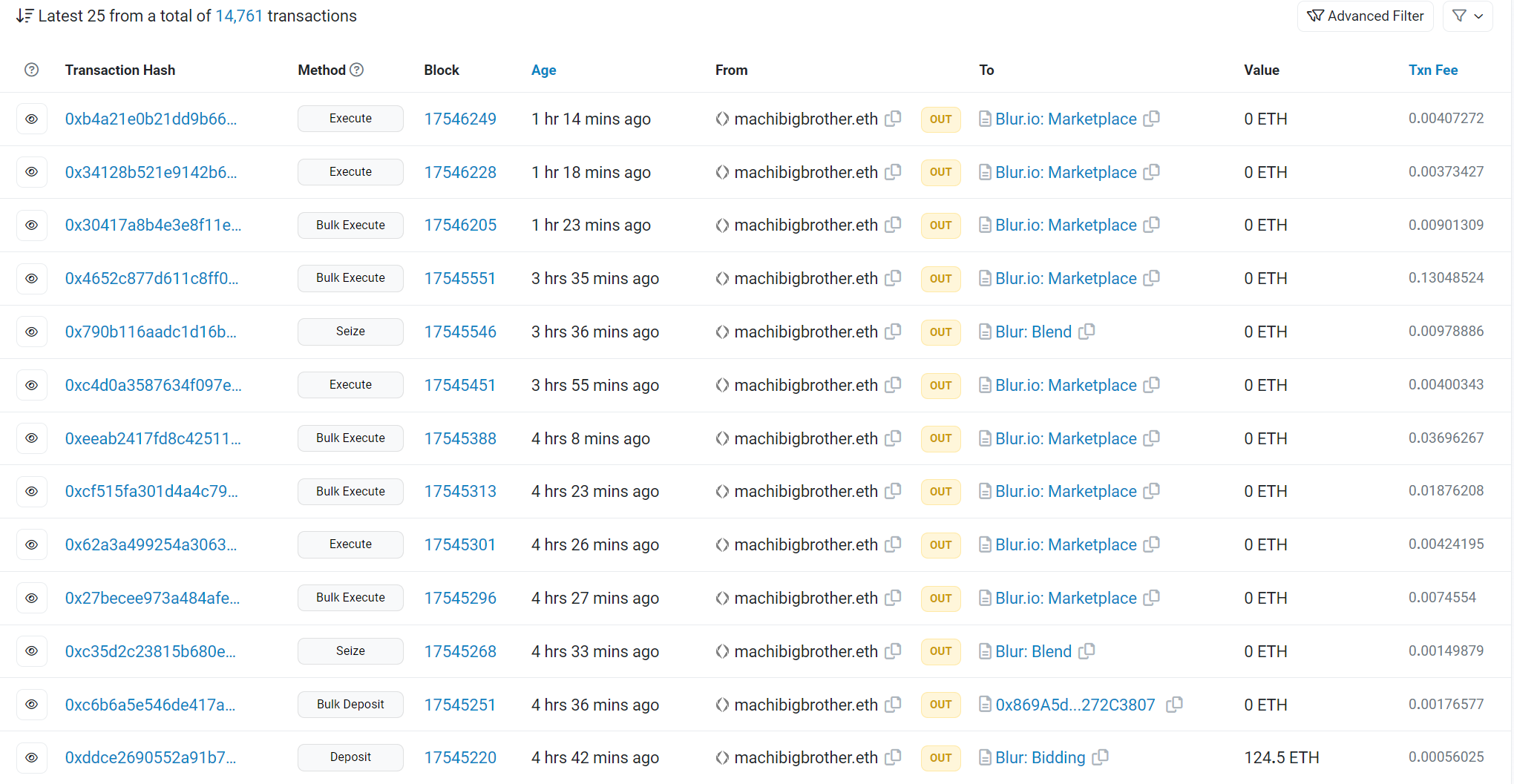

On-chain data shows that in the last 4 hours, Huang Licheng sold some BAYC, MAYC, and Azuki on Blur. Specifically, 1 Azuki is sold for 16.78 ETH; 5 BAYC sold for 183.8 ETH; 12 MAYC sold for 85.48 ETH; 39 BAYC sold for 1428.71 ETH; 3 BAYC sold for 20.57 ETH MAYC.

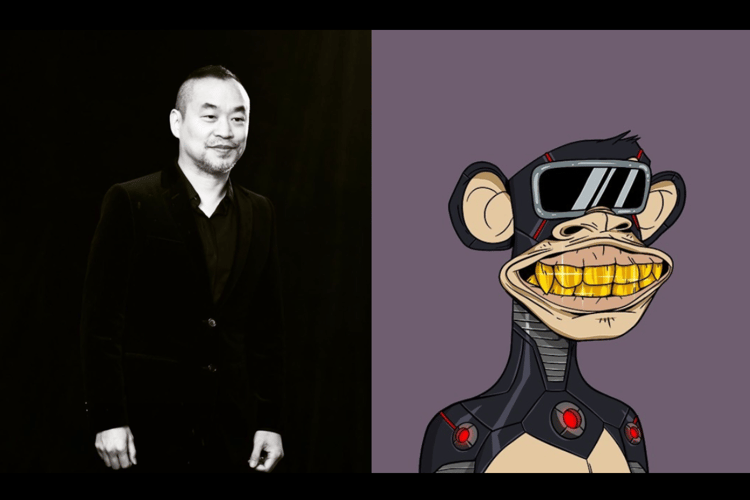

Machi Big Brother was one of the first NFT players with the largest trade size and a major BAYC player. The trading frequency, NFT holding rate, and selling price of this whale all significantly influence the NFT market, especially the floor price of blue-chip NFTs like BAYC.

However, on April 15, Machi Big Brother Whale announced it would withdraw from the NFT market but did not give specific reasons for its decision. This has created a greater sense of uncertainty for the NFT market, especially when the market is quiet.

He recently sued on-chain detective ZachXBT for defamation. Huang Licheng tweeted to refute earlier accusations by on-chain detective ZachXBT. He said that ZachXBT’s allegations of embezzling money were untrue and unfounded.

Huang Licheng Sold A Lot Of BAYC, MAYC And Azuki In The Last 4 Hours 4

First, he did not embezzle 22,000 ETH from Formosa Financial. He has no access to the multisig transferring the ETH vault, and no receiving address belongs to him. Formosa Financial’s many signatures are CEO Ryan Terriblini and CTO Lorne Lantz.

Second, before Cream Finance was hacked twice in August and October 2021, he handed over Cream Finance to other teams in 2020. He re-managed the protocol in February 2022 and recovered funds for users affected by the attack.

In addition, before the accusation of “Squid DAO,” Huang Licheng affirmed that he did not sell or have any improper behavior. He is related to Squid DAO. In January 2022, he supported the proposal to return DAO coins, which resulted in the return of over 12,000 ETH to Squid DAO participants.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.