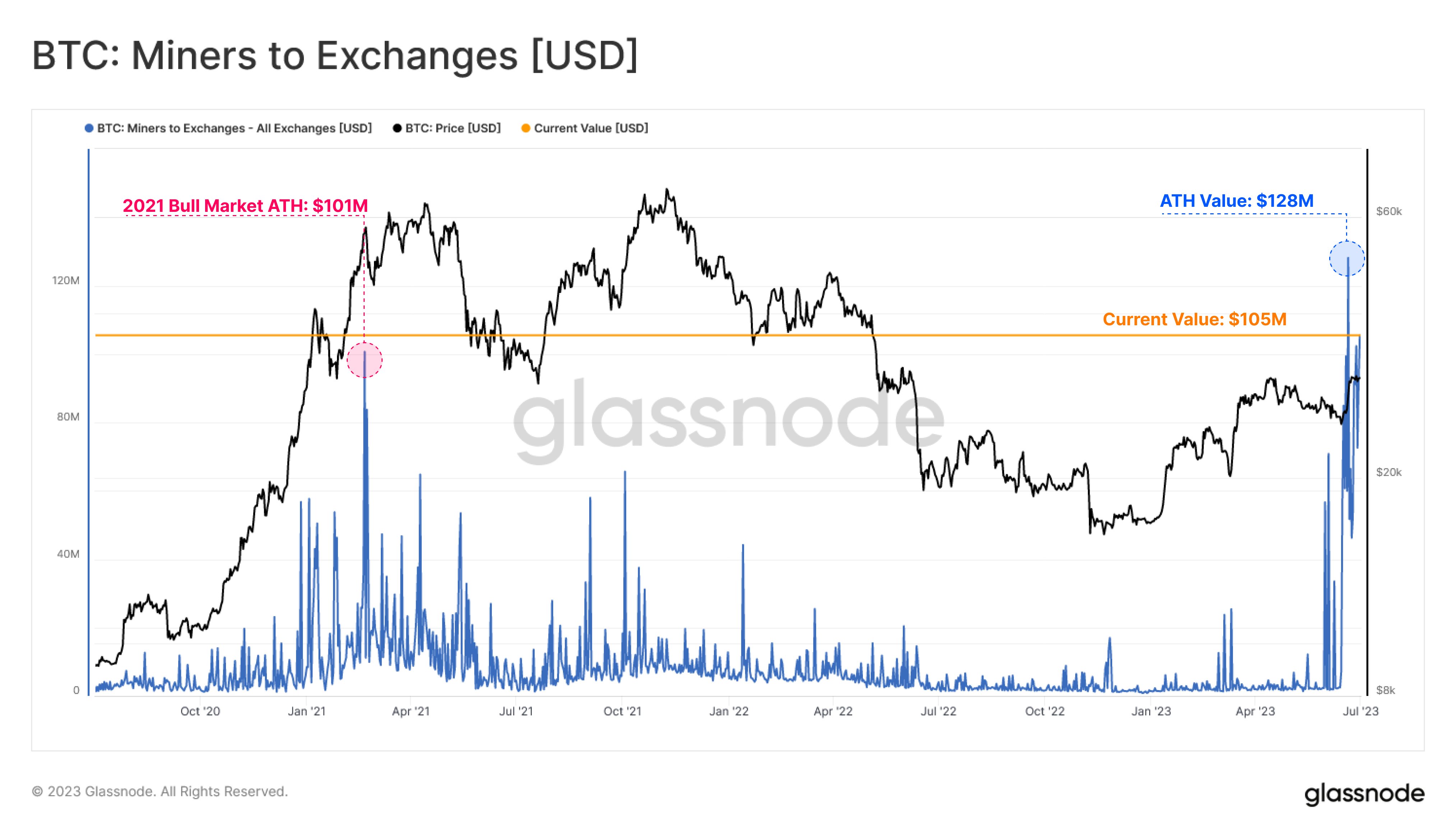

Miners moved $105 million worth of Bitcoin (BTC) onto exchanges as the top crypto reclaimed the $30,000 price point, according to the digital asset analytics firm Glassnode.

Glassnode says it represents the second-largest US dollar-denominated transfer on record.

“Following the ascension in spot price above the psychologically key $30,000 level, Bitcoin miners have continued to send large clips of BTC to exchanges.

Currently, miners are sending $105 million to exchanges, the second largest USD-denominated transfer on record.”

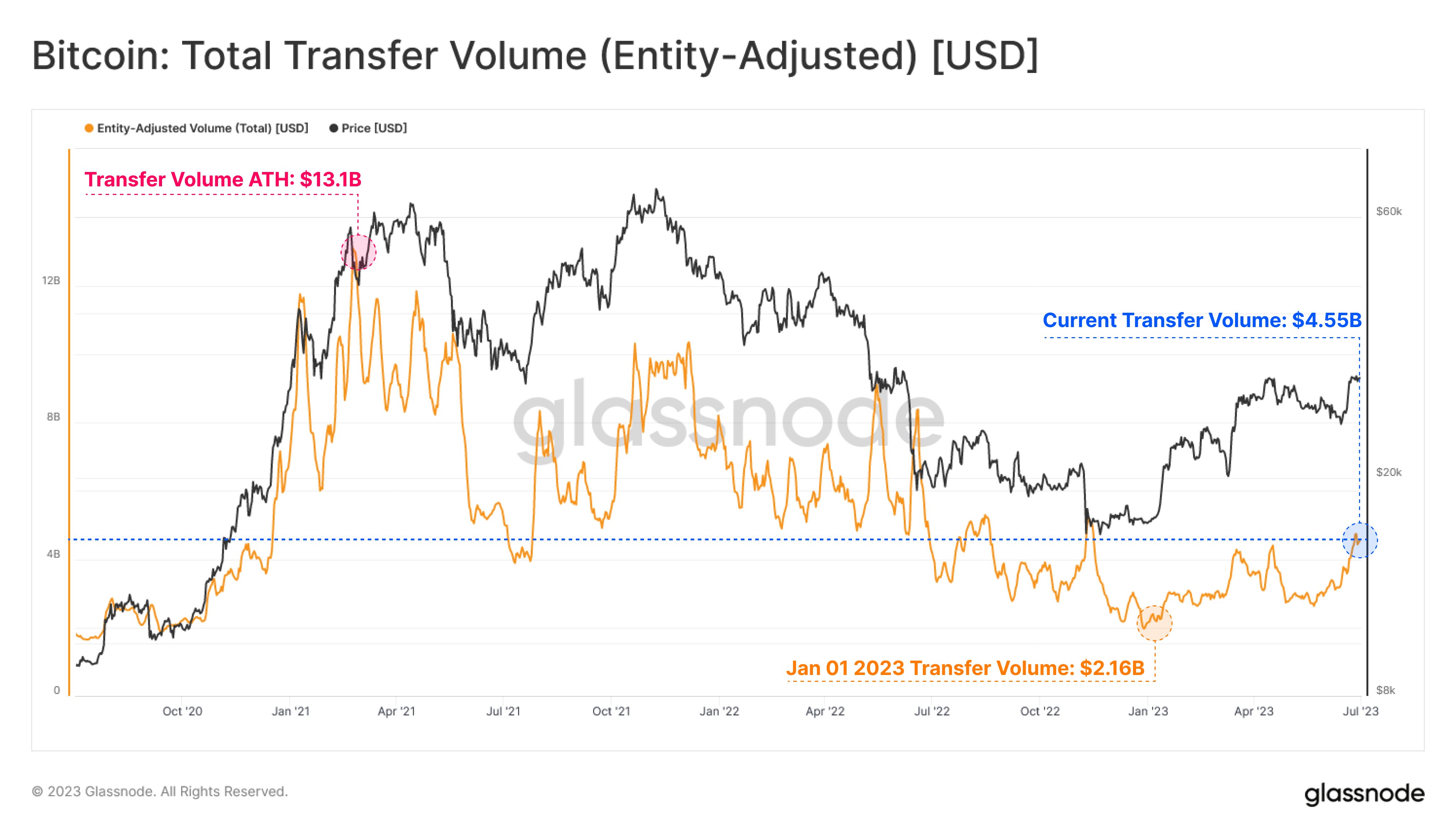

Glassnode also notes that the volume settled on the Bitcoin network has recorded a 211% increase year-to-date, climbing from $2.16 billion to $4.56 billion. The firm says the surge suggests “network utilization continues to improve.”

“However, when compared to the conditions experienced across the 2021 bull market, the current settlement value remains a significant -$8.54 billion (-65%) lower than the ATH (all-time high) of $13.1 billion.”

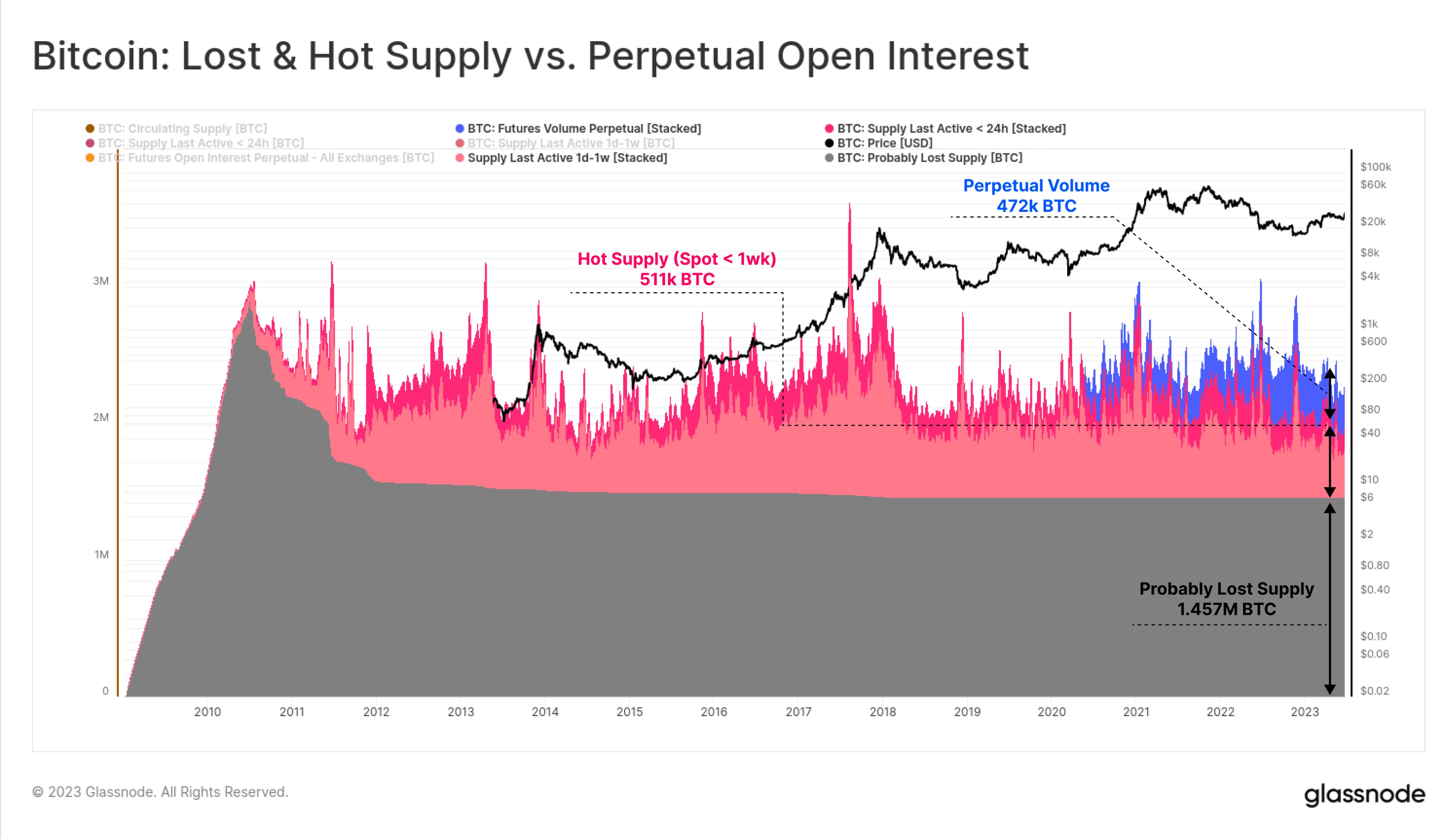

Glassnode also examines Bitcoin’s “hot supply,” a term it uses to approximate the BTC that is actively participating in price discovery. According to the analytics firm, less than $30 billion worth of BTC is available for trading.

“With a median size of 0.67 million BTC and a maximum of 2.2 million BTC, hot supply represents between 3.5% to 11.3% of the total supply.

Perpetual Futures Open Interest (472,000 BTC) and hot supply (511,000 BTC) are similar in size as shown below, suggesting that a volume of around 983,000 BTC (~$29.5 billion) is currently ‘available’ for sale, with just under half of this being spot Bitcoin.”

Bitcoin is trading at $30,907 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Shutterstock/Konstantin Faraktinov