DeFi

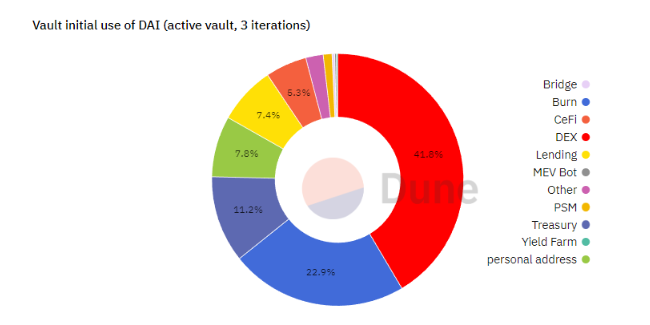

It was noticed by MakerDAO that around 42 percent of the early use cases for DAI, the stablecoin that is issued on the Ethereum blockchain, are within decentralized exchanges (DEXs).

This highlights the growing adoption and importance of DAI in the decentralized finance (DeFi) ecosystem. Other significant use cases include destruction, national debt, lending, and personal address holdings.

Notably, around 70% of the total DAI supply is held in Ethereum addresses, while 22.9% is distributed across bridges, DEXes, lending platforms, and the Dai Savings Rate (DSR). Only a minuscule 0.6% of DAI resides in centralized finance (CeFi) platforms such as exchanges and on-ramps.

Coincu reported that the core development team of MakerDAO has proposed increasing the DAI savings rate to 3.33% in response to soaring interest rates and the need to counter persistent inflation driven by actions of the US Federal Reserve. This adjustment to the DSR aims to attract more users and stimulate DAI usage. Interest will be accrued in real-time based on the system’s revenue, and the proposal is currently undergoing the formal voting process.

The proposed increase in the DSR has garnered strong support from the community, with many believing it will further enhance DAI’s appeal. Some community members have even indicated that they would explore alternatives to DeFi borrowing if the proposal is approved.

As DAI continues to gain prominence in decentralized exchanges and MakerDAO explores measures to improve its savings rate, the stablecoin’s role within the DeFi ecosystem is set to strengthen. These developments are expected to contribute to increased DAI usage and further growth in the decentralized finance space.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu