Aerodrome Finance’s native token AERO surged 152% Tuesday after Base Ecosystem Fund acquired a position in it.

Aerodrome Finance is recognized as the predominant liquidity protocol on the Base blockchain, commanding a market share exceeding 30%. With $134 million in total value locked (TVL), as reported by DefiLlama, Aerodrome’s prominence in the blockchain ecosystem is undeniable.

The Base blockchain, a layer-2 network established by Coinbase, has garnered significant attention and growth, amassing $420 million in TVL since its inception in June.

The involvement of the Base Ecosystem Fund in Aerodrome Finance was publicly announced via a tweet from Aerodrome, expressing enthusiasm for the partnership and the shared vision for the future development of the Base ecosystem.

The Base Ecosystem Fund, led by @cbventures, was launched to invest in the next generation of onchain projects building on @base.

We’re excited to announce that the Base Ecosystem Fund has market acquired a $AERO position. Together we’ll build the future of @base. pic.twitter.com/9b01vw28tg

— Aerodrome (@aerodromefi) February 26, 2024

You might also like: DeFi TVL surpasses 22-month high as market goes bullish

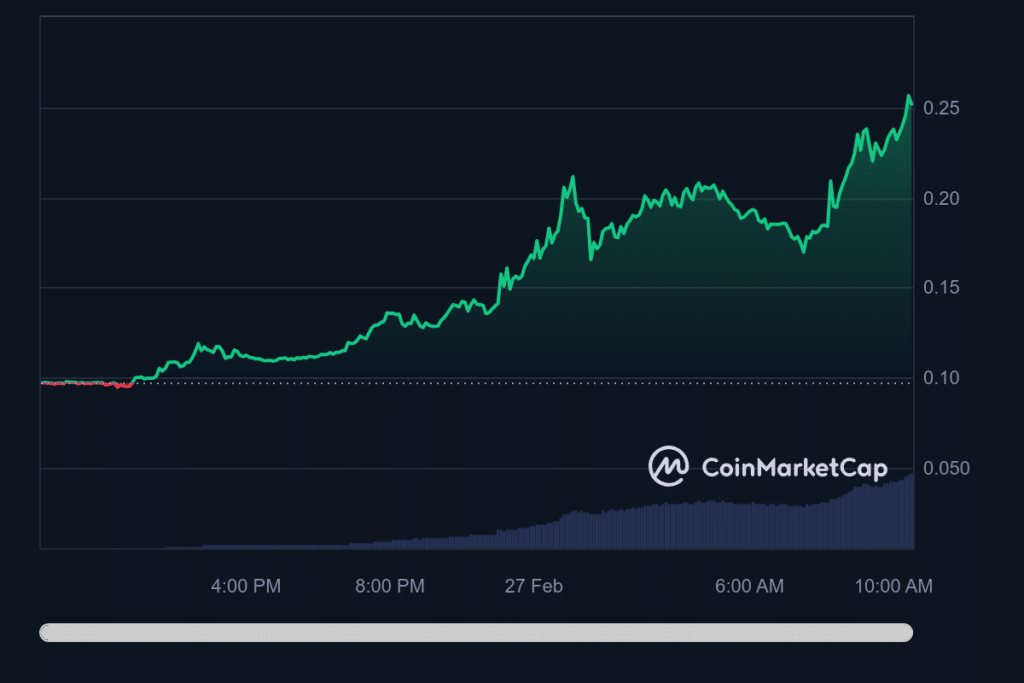

24-hour chart of AERO from CoinMarketCap

Following the announcement, AERO’s market price saw an immediate and significant upswing, trading over 26 cents after having started Monday below 10 cents, according to CoinMarketCap. The price movement indicates a positive market response to the investment, and the potential investors see Aerodrome’s role on the Base blockchain.

Moreover, Base’s investment in AERO is part of a broader strategy of supporting emerging projects in the blockchain space.

Before this investment, the fund had already supported various projects in October, including Avantis, BSX, Onboard, OpenCover, Paragraph, and Truflation.

Read more: Coinbase CEO clarifies why company has no plans for Base token