A closely followed crypto strategist is calling Bitcoin (BTC) an easy trade over the long term due to one possible catalyst.

Pseudonymous analyst The Flow Horse, also known as Cantering Clark, tells his 180,900 X followers that he is long-term bullish on BTC because he believes the U.S. Securities and Exchange Commission (SEC) will eventually approve Bitcoin spot exchange-traded funds (ETFs).

“I love the people that are still vehemently bearish on Bitcoin while being completely aware that an ETF is coming. Do you realize how much is going to go into marketing these instruments while they are live? This is such an easy long-term trade.”

The Flow Horse notes that his bullish outlook does not mean a straight upwards trajectory for the king crypto, but periods of volatility.

“The best part about posting something like this is how people interpret what timeline this applies to. Always someone who is going to think this means literally UP ONLY from the last price before the post.”

Bitcoin is trading for $29,369 at time of writing, down 0.1% in the last 24 hours.

Next, the trader updates his outlook on memecoin Shiba Inu (SHIB). He notices open interest and funding are going up, indicating a move to the upside may be coming soon.

“Looks like someone is building a long position further in SHIB, which also is about to be narrative driven. Up more.”

Shiba Inu is trading for $0.0000101 at time of writing, up 2.3% in the last 24 hours.

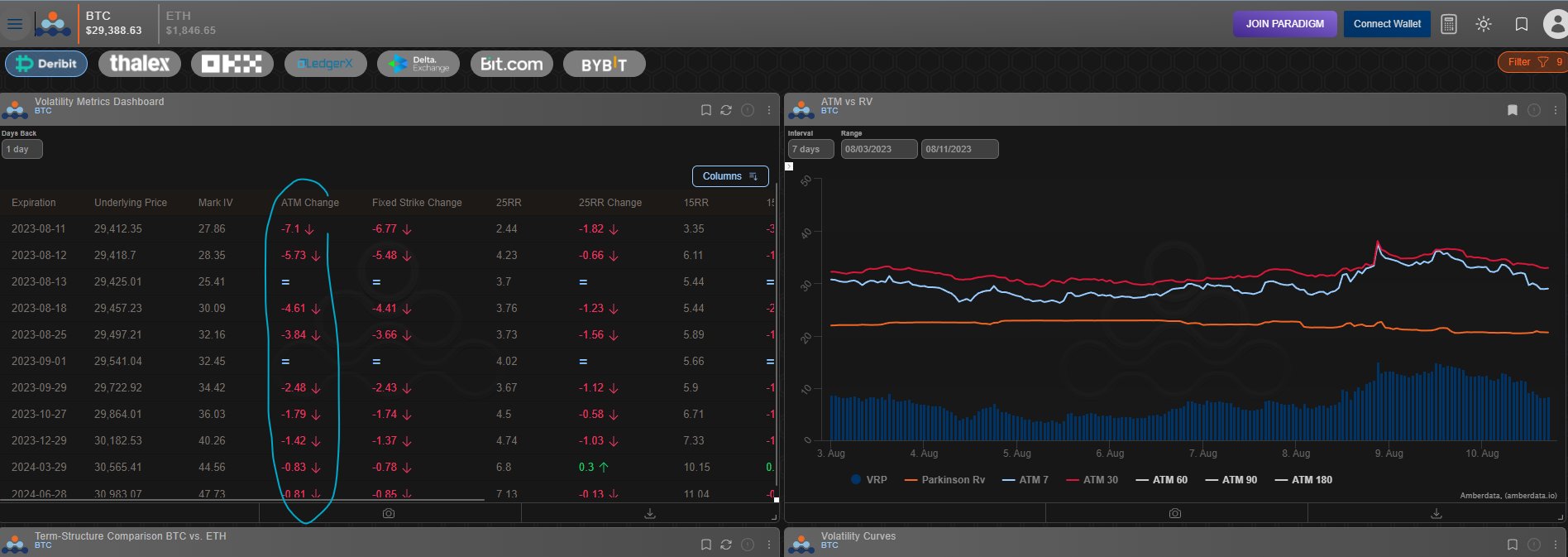

The Flow Horse is also closely watching Bitcoin’s at-the-money implied volatility, which forecast’s a likely move in price, and he says it shows Bitcoin is seeing selling pressure.

“Damn volume buyers can’t catch a break. Almost as if no one has any real expectations in the near future. Front end bumped up, is still higher than where it was a week ago before the recent pop, but getting sold once again.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Catalyst Labs/Sensvector