- BTC hits $64,000 for the first time since 2021.

- Open interest is now close to $27 billion.

Bitcoin [BTC] recently made waves, showcasing significant price hikes and strong moves in some of its metrics.

Bitcoin steps into a new price zone

On the 28th of February, Bitcoin exhibited noteworthy price action, closing at about $62,393 on the daily timeframe chart, marking a notable increase of over 9%.

However, a more detailed examination of lower timeframes revealed that BTC reached a peak of $64,000 before retracting to its closing range. This over 9% surge concluded a five-day streak of consecutive increases for BTC.

Additionally, it’s worth highlighting that this price level marked the first time since 2021 that Bitcoin reached the $60,000 range.

At the time of this writing, Bitcoin was trading close to $63,000, with an almost 1% increase observed. Furthermore, the recent upswing has propelled Bitcoin into the oversold zone, as indicated by the Relative Strength Index, which was at over 85 at the time of this writing.

Key Bitcoin metrics show yearly highs

Analysis of Santiment data showed that Bitcoin experienced significant increases in its price, whale transactions, transaction volume, and daily circulation. These metrics have reached unprecedented levels since 2022.

By the end of 28th February, transaction volume rose to over $38 billion, whale transactions exceeded 4,000, and daily circulation surpassed 322,000.

At the time of this writing, transaction volume was nearing $3 billion, whale transactions had surpassed 600, and daily circulation had exceeded 16,000.

Furthermore, an examination of BTC volume showed that it closed at over $80 billion on 28th February, reaching a peak. Presently, the volume is over $93 billion, marking the first time since 2022 that it reached these elevated levels.

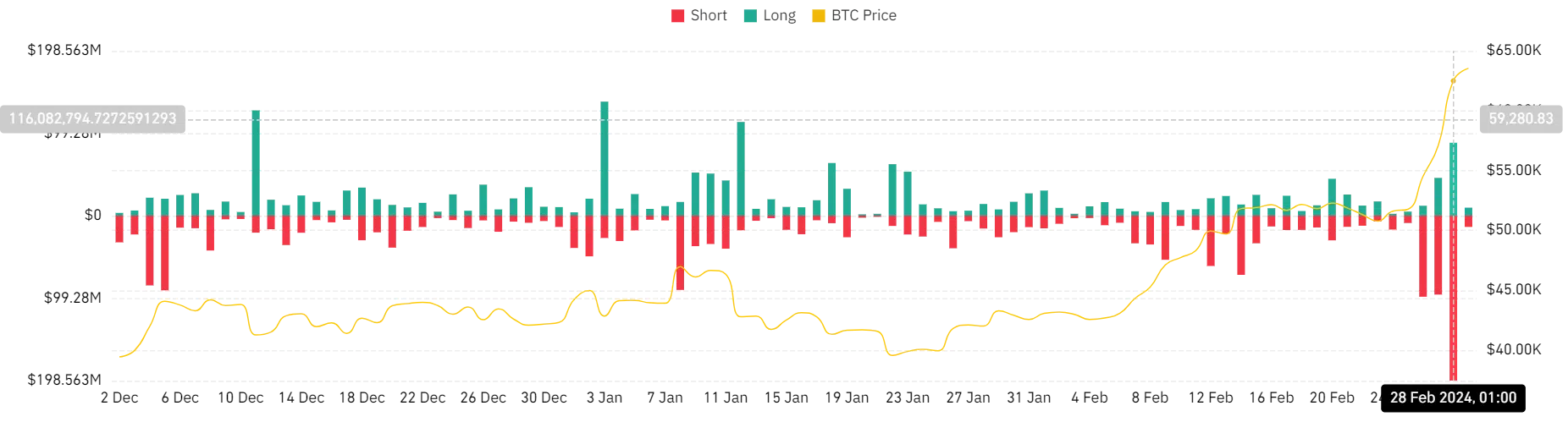

Short and long positions take significant hits

The notable surge in Bitcoin’s price led to a substantial liquidation of positions, according to data from Coinglass. On 28th February, the BTC liquidation volume was over $286 million.

A detailed breakdown revealed that short positions experienced the most significant liquidation, totaling over $198 million. In comparison, long positions saw nearly $88 million in liquidation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Interestingly, despite the substantial liquidation volume, there was a continuous influx of funds into BTC.

An analysis of the Open Interest metric showed a surge to its highest point in months, approaching $27 billion at the time of this writing.