- Last month, miners sold less than 1/3rd of the total coins sold in February

- HODLing might also be motivated by the negative state of the market currently

The countdown to Bitcoin’s [BTC] halving has begun, with the hotly-anticipated event set to take place in less than 12 hours.

Miners, who guard the network and earn incentives in the form of block rewards, are set to face a big hit to their revenues in the aftermath of the event. Typically, miners start liquidating their holdings ahead of the halving to capitalize before the revenue hit later.

This time, however, has been different.

Miners reduce selling pressure

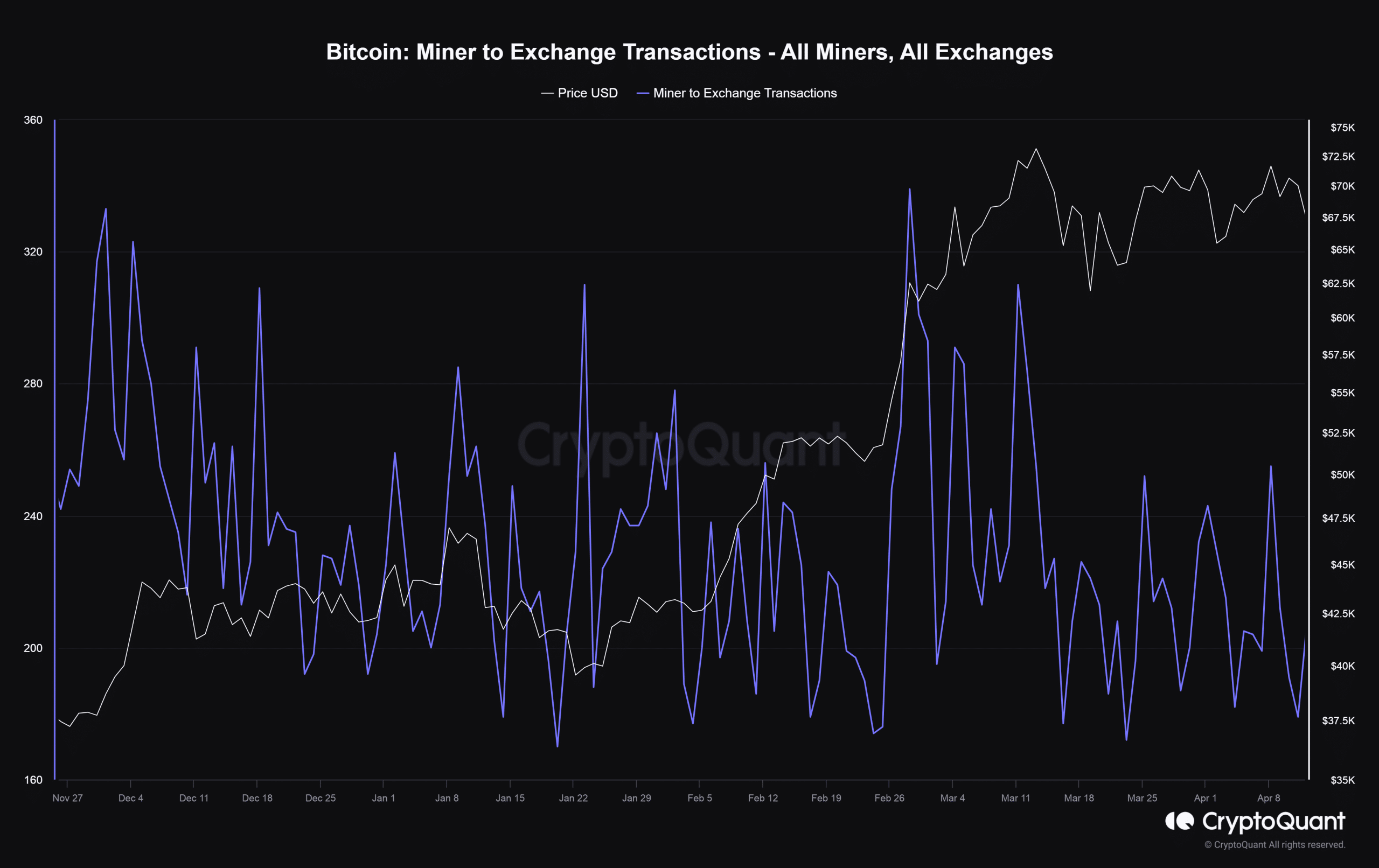

According to a researcher at on-chain analytics firm CryptoQuant, around 374 BTCs were sent by miners daily to spot exchanges on average over the past month – Less than one-third of the daily average recorded in February.

Source: CryptoQuant

The researcher claimed that this action helped prevent additional downside pressure on the king coin.

“It is possible that the selling pressure has already been executed in advance by miners, something that could benefit the market in the short term, especially when there is already significant pressure on the market due to the feeling of risk aversion.”

Weak returns spurring HODLing?

Additionally, the HODLing might have been motivated by the ongoing market slump, which has seen BTC lose more than 12% of its value over the week. Miners might be waiting for a post-halving rally to get better returns on their sale.

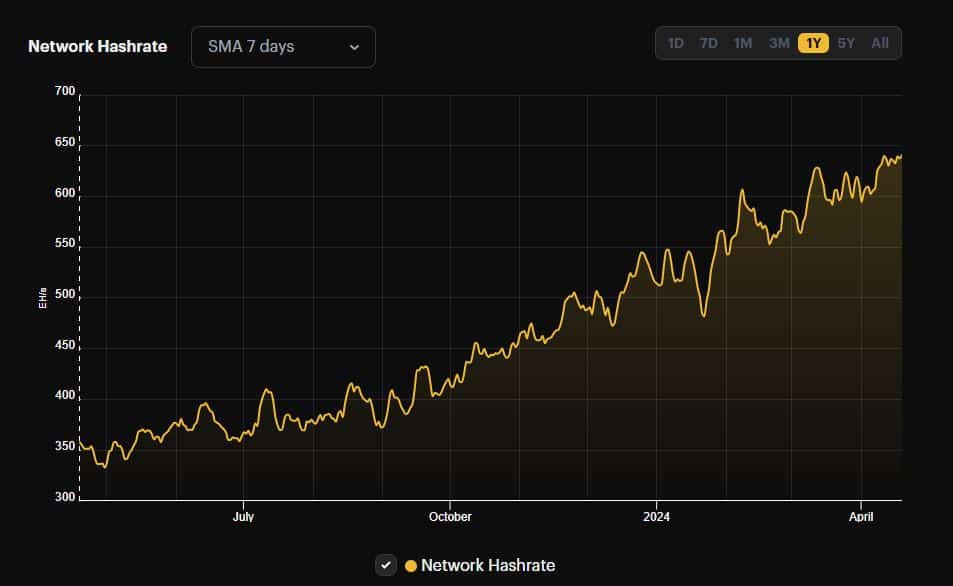

Machines running on full strength

Meanwhile, the network hash rate, a measure of the total computational power dedicated by miners, rose to 641 exahashes per second (EH/s), at the time of writing. The hash rate has surged ahead of the halving, indicating miners’ push to maximize their earnings before they are halved eventually.

Source: Hashrate Index

Is your portfolio green? Check out the BTC Profit Calculator

Here, it’s worth noting that Bitcoin tanked below $60,000 during Asia trading hours Friday due to heightening geopolitical tensions in the Middle East. However, the digital asset recovered to $62,000 at press time, as opportunistic traders capitalized on the the dip to accumulate more.