The tokenization of real-world assets has offered promise and frustration in equal measure, but one blockchain platform claims regulation is the key to success.

While TradFi incumbents applaud their potential for more efficient settlements, others argue tokenization is over-hyped and negates crypto’s decentralization premise. Swarm, a fully-regulated decentralized platform that tokenizes real-world assets for use in decentralized finance, begs to differ.

In an interview with BE[IN]CRYPTO, co-founders Philipp Pieper and Timo Lehes argue regulation is the key, not the enemy, to preserving the reputation of the blockchain sector after the failure of FTX. Does Swarm have the answer to the future of crypto in the US?

We explore the answer here. But first, we need a brief intro tokenization, the engine powering Swarm’s optimism.

A Brief History of Tokenization and the Rise of NFTs

Digital tokenization started in the 2000s to protect sensitive data from unauthorized use. Essentially, a third party would receive affirmation of sensitive information without being granted direct access.

Tokenization process in e-commerce | Source: Ebanx

Before that, in the eighteenth century, the US government secured or tokenized dollars with physical gold until 1971. Later, the fiat system issued banknotes backed by the full faith of the US government.

Today, companies wishing to protect sensitive data store tokens on the cloud. Payment companies like Mastercard grant third-party access to customer data through the exchange of tokens.

However, the advent of the Ethereum blockchain in 2015 and its tokenization standards have since transformed the rights tokens bestow on owners. Non-fungible tokens, or NFTs, grant holders immutable custody of digital or physical assets.

On most chains, an asset owner tokenizes their property through a special process called “minting.” NFTs on Ethereum must conform to its Request for Comment-721 token rules.

In the minting process, the creator must include bits of information in the NFT, such as the main content that will be unlocked when a buyer takes ownership. For example, in the case of a Bored Ape Yacht Club NFT, the main content is a 2D drawing of a cartoon ape.

The NFT may also contain perks that creators use to increase the token’s value. Extras can include access to online forums and physical events.

Until now, most major corporations have struggled to realize the full business potential of NFT perks. Gucci, Chipotle, Nike, and Starbucks are among the few to have realized the potential of tokenization in rewarding loyal customers.

Banks Lead Commercial Applications of Tokenization

But traditional finance firms, weighed down by legacy networks, have long been testing the technology’s ability to settle transactions quickly.

Citigroup tokenized a proprietary asset, Citicoin, on its private network in 2015. It later tapped Swiss crypto company Metaco to hold customers’ digital assets.

JPMorgan’s JPM Coin tokenized dollars for client payments on a custom chain in 2019. It recently tokenized euros with JPM Coin, with German Conglomerate Siemens AG performing the first transaction.

Investment bank Goldman Sachs said in November last year its blockchain efforts would focus on tokenization and the rewiring of financial markets. Later that year, Singapore’s central bank tested tokenized fiat currency transfers through a blockchain asset pool.

In July, South Korea’s oldest bank confirmed its testing of remittances with several tokenized Southeast Asian currencies.

Swarm Says Tokenization is the Path to Regulated DeFi

But can tokenization move beyond legacy banking? Yes, says Swarm, a fully-regulated platform linking the safety of TradFi regulation with the freedom of decentralized finance (DeFi).

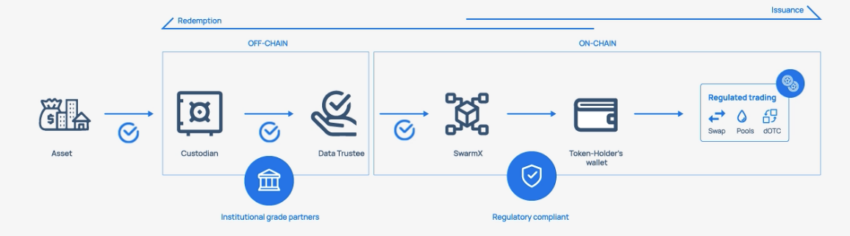

Swarm opens DeFi access to tokenized bonds and securities backed by regulation. It keeps customer assets with an institution like Gemini or Coinbase, which protect keys giving access to digital tokens.

How a customer withdraws tokenized asset | Source: Swarm

A “withdrawal” pulls the asset from the custodian through a digital trustee onto Swarm’s network. From there, the asset is transferred to a customer wallet for use in DeFi.

Interested in how DeFi protocols use assets as collateral? Read more here.

Swarm’s bosses argue the right mix of regulation and decentralization is key to the survival of the crypto sector after the failure of FTX. They argue,

“The standards for bringing assets on-chain need to be rigorous, and the onus is on those in the tokenization space to get this right. Failing to do so will result in a loss of confidence in the blockchain sector.”

Swarm has secured a license to trade tokenized assets with the German finance agency BaFin. While the process required compliance with anti-money laundering and capital regulations, the pair argues their business later “felt very much like DeFi.”

“Being one of the first BaFIN-regulated DeFi companies was no walk in the park. This is because DeFi is not a natural fit for the regulatory models of traditional finance.

They liked the fact transactions are on-chain, meaning they can look under the hood themselves to see what is going on, rather than relying solely on a report we generate ourselves months down the line.”

The BaFin license also means Swarm won’t need new vetting when Europe’s Markets in Crypto-Assets bill goes into effect in 2024.

The founders claim Swarm is the first decentralized platform to offer regulated trading of tokenized assets. The company offers tokenized stocks of publicly traded US companies, including BlackRock, Coinbase, Nvidia, and Microsoft.

Liquidations in DeFi Applications Challenge Swarm Tokenization Promise

It remains to be seen whether tokenized assets will upend DeFi markets as Swarm hopes. Several recent exploits have revealed the fragility of the industry and its need for better code audits.

Notably, Swarm didn’t discuss the implications of losing a digital asset locked in a borrowing smart contract.

Additionally, the founders didn’t detail how Swarm would process liquidations if DeFi loans became undercollateralized. DeFi players may also be uncomfortable leaving their most expensive assets vulnerable to theft.

Currently, few countries’ laws fully address DeFi risks. Earlier this year, the US SEC said it could crack down on DeFi services breaking current US exchange rules.

MiCA will likely tackle the issue when revised, while a new DeFi US bill awaits Congressional passage. The bill imposes money laundering checks on DeFi apps.