New data reveals that prominent centralized exchange (CEX) platforms, including Crypto.com and Bybit, saw their trading volumes surge in December.

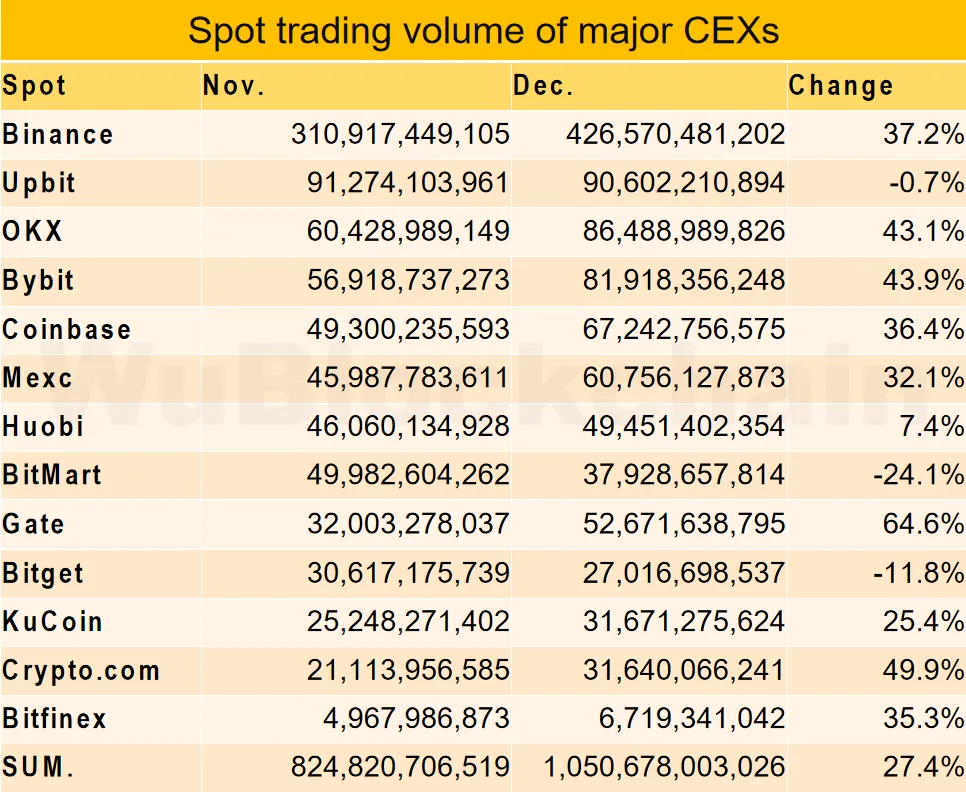

According to blockchain reporter Colin Wu, in December, the overall spot trading volume of centralized crypto exchanges rose 27.4% month-on-month despite some of them seeing notable dips.

“In December, the spot trading volume of major exchanges rose by 27.4% month-on-month. The top three in terms of percentage change were Gate at 65%, Crypto.com at 50%, and Bybit at 44%. The bottom three were BitMart at -24%, Bitget at -12%, and Upbit at -1%.”

According to Wu’s data, derivatives trading on major crypto exchanges rose 22.3% month-on-month while overall traffic to their websites saw a 21% month-on-month increase.

“For derivative trading volume in December, there was a 22.3% month-on-month increase among major exchanges. The top three in percentage change were Crypto.com at 46%, Bitget at 42%, and Binance at 26%. The bottom three were Mexc at -13%, Huobi at -5%, and Kucoin at 14%.

Regarding website traffic for major exchanges in December, there was a 21% month-on-month increase. The top three in percentage change were Mexc at 45%, Bybit at 38%, and Gate at 34%. The bottom three were Huobi at -80%, BitMart at -17%, and Bitget at 8%.”

In December, market intelligence platform Glassnode suggested that an increase in flows into crypto exchanges meant that institutional investors were readying themselves for the potential approval of a spot market Bitcoin (BTC) exchange-traded fund.

At the time, an analysis by the firm found that the 30-day simple moving average (SMA) of Bitcoin flows in and out of exchanges grew 220% from the start of the year, shooting up to $3 billion from $930 million.

The U.S. Securities and Exchange Commission (SEC) is slated to approve or reject spot market BTC ETFs sometime today.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney