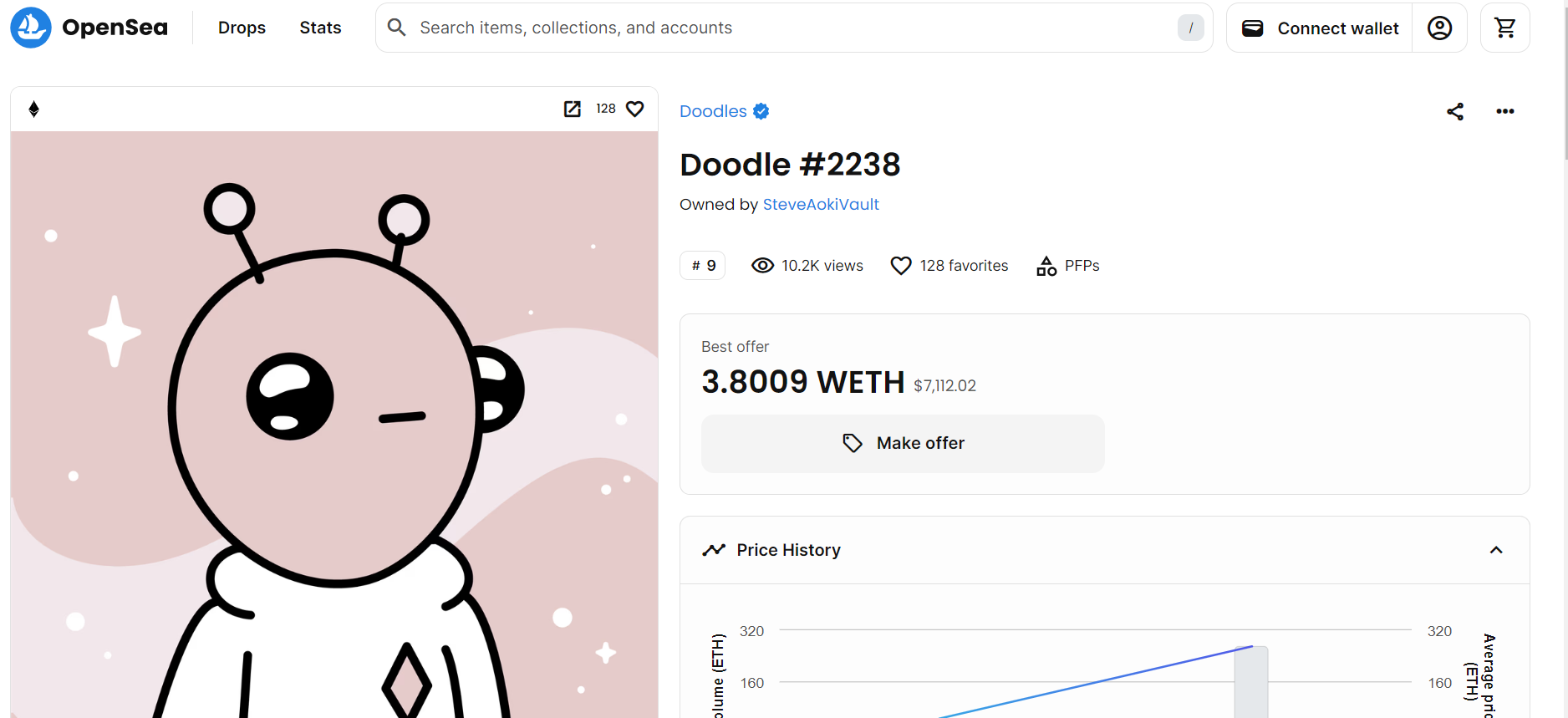

Among the notable collections that have taken a significant hit in value is the Doodle 2238, which was initially purchased for an astounding $862,000. The current highest bid for this NFT stands at just $12,000, resulting in a substantial loss for Aoki.

How Steve Aoki turned $1.6M into $33K trading NFTs ↓ pic.twitter.com/qnuWNgv2vM

— Herbie (@liamherbst_) July 22, 2023

Similarly, Aoki’s investment in The Cool Cat 8665 NFT, which he acquired for $123,000, has also suffered a drastic devaluation. The highest bid for this particular token now stands at a meager $4,700.

The 3 Moonbirds NFTs, previously acquired by Aoki for $297,000, have experienced an astonishing 97% decrease in value.

Additionally, the Cryptomories 1026, once purchased for $483,000, has been sold off for a mere $15,000, leaving Aoki with a staggering loss of $468,000 on this particular investment.

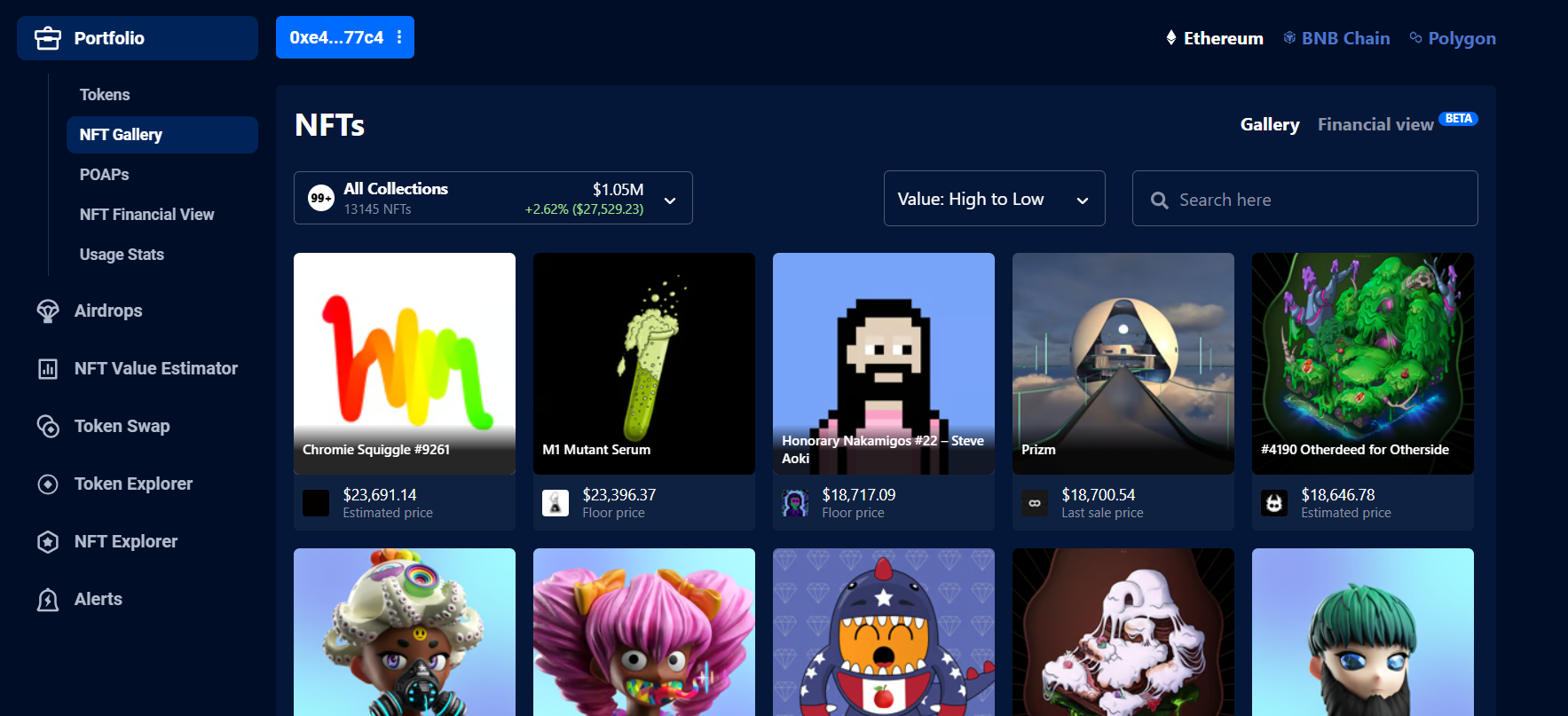

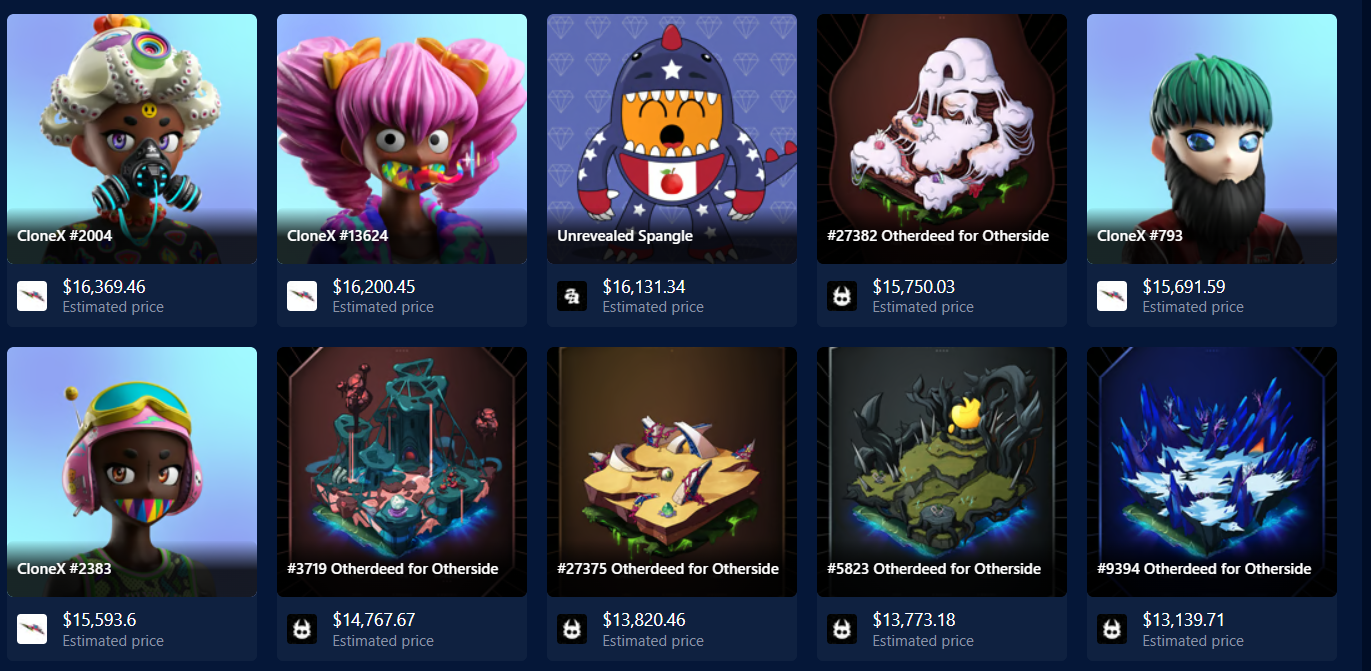

According to data from DappRadar, Aoki currently holds over 13,000 NFTs, with an approximate total value of $1.05 million. However, a few months ago, in early June, these NFTs were valued at an impressive $8.8 million, highlighting the substantial depreciation in their worth.

NFTs, which are unique digital assets that represent ownership of artwork, music, or other collectibles, have gained considerable popularity in recent years. The crypto art market witnessed a boom, with NFT sales reaching remarkable heights. However, the volatility of the market has also exposed investors to potential risks, as seen in Aoki’s case.

DJ Steve Aoki faces substantial losses as the value of his blue-chip NFTs experiences a significant decline. Herbie’s calculations reveal that NFTs once worth $1.6 million are now valued at just $33,000. The market volatility underscores the importance of careful consideration and research when investing in NFTs and the crypto art market as a whole. As the market continues to mature, investors must remain vigilant to make informed decisions in this dynamic and ever-changing industry.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.