DeFi

According to Wu blockchain, the Fantom network accounts for the highest proportion of Multichain’s $1.76 billion TVL, reaching 36.7%. The assets on the Fantom network are about $1.66 billion, and nearly 40% of the assets are wrapped assets of Multichain.

Among the $1.76billion TVL of Multichain, the Fantom network accounts for the highest proportion, reaching 36.7%; the assets on the Fantom are about $1.66 billion, nearly 40% of the assets are wrapped assets of Multichain; the main stablecoin on Fantom is 191 million, USDC and 82…

— Wu Blockchain (@WuBlockchain) May 26, 2023

The main stablecoin on Fantom is 191 million USDC and 82 million USDT assets are issued by Multichain. Although Multichain is Fantom’s official cross-chain bridge, most chains operate normally, and there is no sign of a de-peg of USDC and USDT on Fantom.

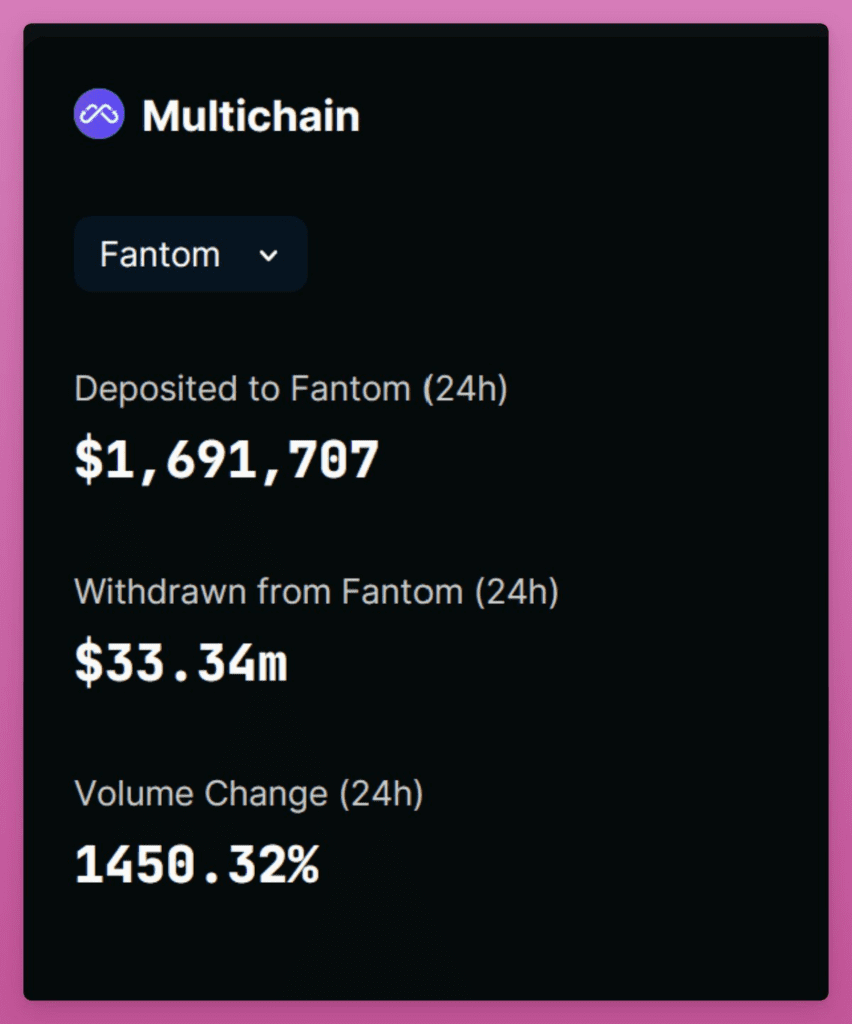

Previously, a Twitter account known as “Ignas | DeFi Research” reported the rumors spreading on Twitter that the Multichain team had been arrested leading to a FUD resulting in a 5x increase in daily bridging volume.

1/ Rumors are spreading that the Multichain team has been arrested.

The FUD resulted in a 5x increase in daily bridging volume.

What does other on-chain data reveal? pic.twitter.com/kqmuAOUxtp

— Ignas | DeFi Research (@DefiIgnas) May 25, 2023

Despite this, the bridging volumes do not show signs of panic. “An Ape’s Prologue” reported that Fantom is the most exposed to Multichain’s wrapped tokens. 35% of its TVL locked depends on these wrappers. Multichain issues 40% of non-$FTM assets ($650M) and handles 81% of Fantom’s total stablecoin MC.

After the rumors involving the Multichain team being arrested, we decided to take a look at the protocols with the highest exposure to it.

In first place comes Fantom, with 35% of its total TVL locked in it and a significant portion of the chain’s assets issued by the bridge. pic.twitter.com/ZTp6TH1bod

— An Ape’s Prologue (@apes_prologue) May 24, 2023

Although the amount withdrawn was larger than deposited by $18M, it is only 1% of its total TVL of $1.78B USD. Not much panic was seen.

Fantom should have experienced a significant outflow of TVL due to its reliance on Multichain. Although TVL has dropped by 9.55% in USD, adjusting for the price of FTM, the data shows no significant outflow of capital. The clearest sign of panic is the Multichain LPs on Fantom.

A total of $33M USD has been withdrawn by LPs from Fantom, with only $1.7M in deposits. Multichain reported that “some of the cross-chain routes are unavailable due to force majeure” and that Kava, zkSync, and Polygon zkEVM routes were temporarily suspended. Eighty-three transactions were pending for more than a day.

It is important to note that on-chain data does not reveal a massive capital outflow. However, the lack of communication from the team is worrying. The current Multichain CEO, Zhaojun, hasn’t been online in a week.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.