What is Fibrous ?

StarkNet is an ecosystem that receives great attention from investors. Although StarkNet is in the Alpha process, there is already a development project on this ecosystem. This article will teach about Fibrous Finance – a Dex Aggregator on StarkNet.

Fibrous Finance is a decentralized Dex Aggregator exchange developed on StarkNet. This platform will aggregate the liquidity of all Dex AMM exchanges on StarkNet and provide the best rates to users.

The project designed a user-friendly interface, making transactions on StarkNet more efficient and accessible to newcomers. Currently, the project is allowing users to experience Testnet.

How does it work?

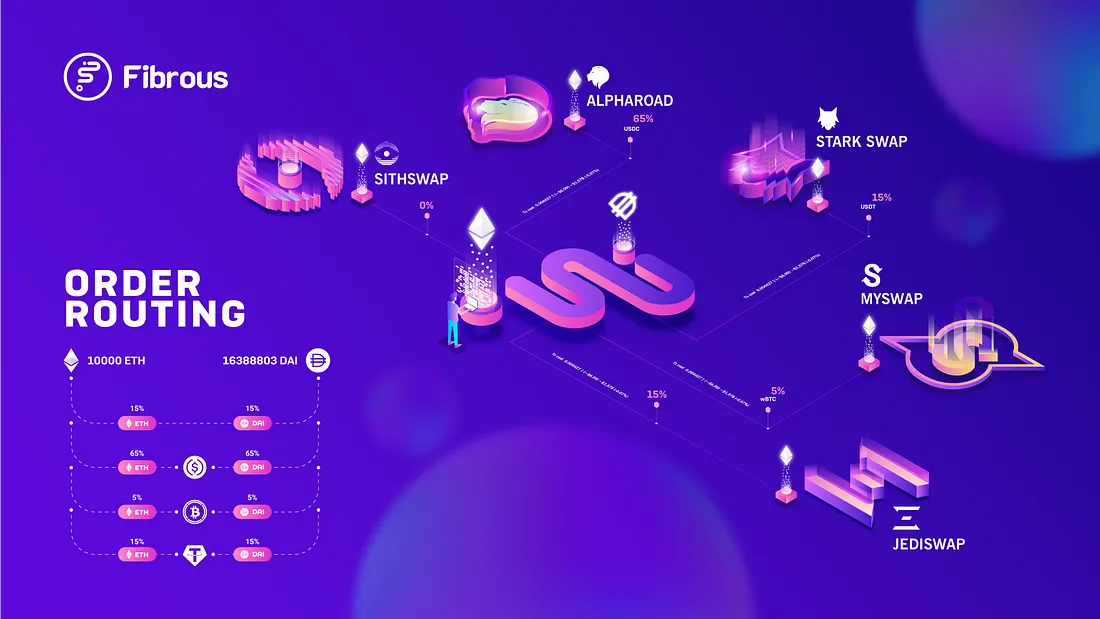

Fibrous is not a traditional AMM. No liquidity is provided to the platform. Fibrous is just an optimal routing finder on all StarkNet AMMs. With Fibrous, you don’t need to search for the best liquidity and price for your tokens between different StarkNet AMMs. The platform will automate this process for you. It will bring all the liquidity in StarkNet close to you. It serves to exchange the most convenient route for you by dividing your coins in the best way.

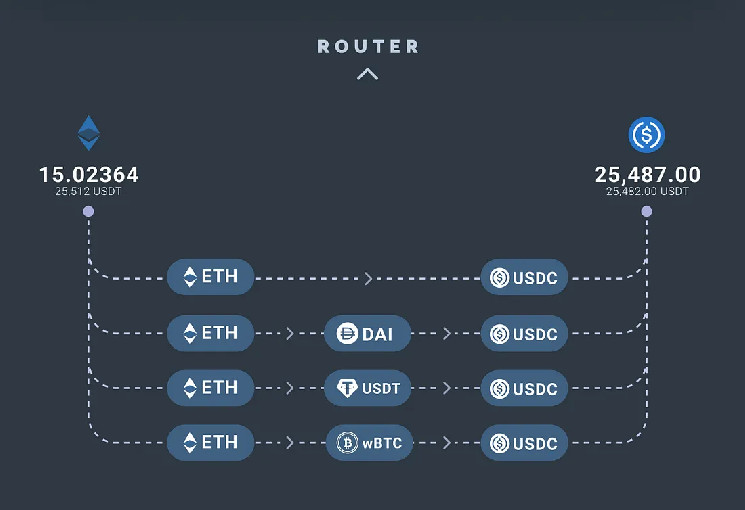

Fibrous uses an advanced optimized order routing algorithm to find better prices for you on StarkNet. One way Fiber Routers get a better price is to split your money across multiple pools and different AMMs through all of StarkNet’s aggregations.

As you know from traditional AMMs, a swap is always done through a single route in legacy routing. If you want to swap TokenA for TokenB, traditional AMMs will execute this transaction from a single pool with the highest possible liquidity. If there is not enough liquidity for this trade, you will face high negative slippage, and the price impact of your trade will result in a loss.

Even if an AMM performs a swap with multiple routes, it will only route from its own buckets. Similar to Uniswap v3 Smart Order Router. While this route is perfect for AMM, it’s still not enough. Because current routing only takes place within the group on a single AMM.

Fiber, on the other hand, goes a different route. Fibrous scans every AMM on StarkNet, any AMM, any group and finds the best price for you. In short, it is an AMM agnostic algorithm that only cares about the best swap rate for the trader by dividing your funds.

This is really special especially for large volume Swap orders because we also know the liquidity of some Dex exchanges is not really good and for large-volume Swap orders, it will create high slippage, causing losses for investors.

What makes it different?

Consolidate all liquidity resources on one blockchain

Although StarkNet is in the Alpha process, we believe that StarkNet has great potential in the future. We anticipate that more AMM protocols will be announced on StarkNet over time. StarkNet is a valid Rollup that ensures Ethereum security and allows for very cheap transaction fees.

This is great but comes with a few things that could be improved. Many AMM protocols have been published on StarkNet, and due to the distribution of liquidity to many AMMs, it will be a bad experience for end users to find the protocol that offers the most liquidity and the best rate among them this AMM protocol.

This is where Fibrous comes into play. Instead of manually navigating each AMM that gives the best rate, Fibrous allows users to swap the best rate with one click in the cheapest way without extra effort. Just exchange for the best possible price in StarkNet. Yarn aggregates all StarkNet AMMs in one place.

The aggregator offers the best price

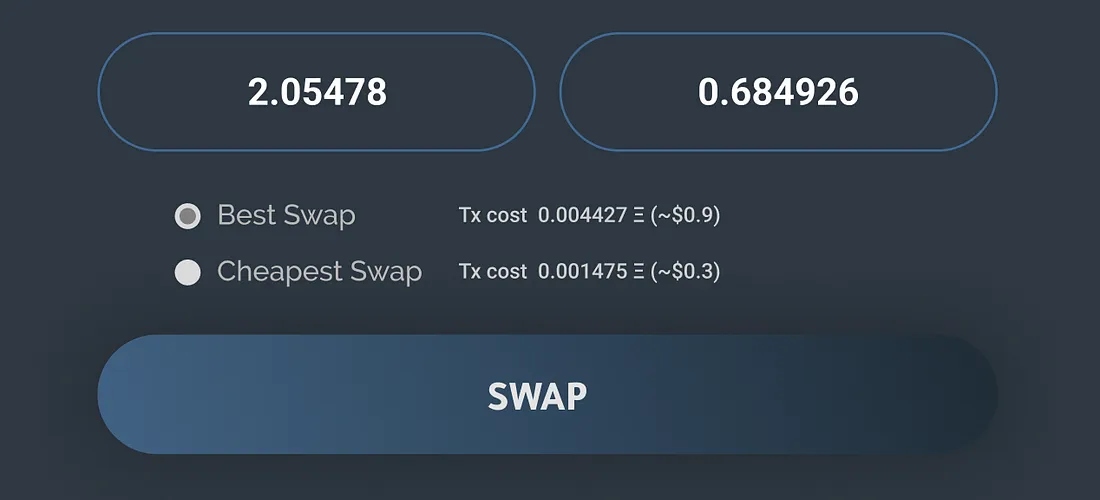

Offering only the best prices does not automatically earn the title of the best aggregator. In fact, the main goal of aggregators is to secure the most favorable price. However, in pursuit of providing the best rates, aggregators should also take into account the transaction costs associated with performing such operations.

Gas spending varies between each AMM, including pools within these AMMs, and even per token, thus resulting in different transaction fees. As a result, each AMM, pool, and token uses a different method of calculating transaction fees. An effective aggregator should prioritize providing the best price allocated after transaction fees rather than just offering the best price at face value.

It is essential to remember that transaction fees increase in proportion to the number of routes and divisions that an aggregator uses for swaps. Therefore, a careful balance is needed between the number of routes taken and the optimization of transaction fees.

Functions

On January 6, 2023, Fibrous Finance launched the v2 version with many features, such as:

Tokenomics

Currently, the project claims to have an intention to issue tokens without a real and quality use case. For the future of Fibrous, the team may evaluate the token later. The sole goal of the project right now is to make Fibrous a better place for users.

Charging mechanism

Thanks to StarkNet, fees will be extremely low, ensuring the safety of Ethereum. However, each fund divided by Fibrous will be an additional cost to the user. To mitigate this, Fibrous will split your funds into five paths and offer another solution for lower trades.

Fibrous is a protocol that provides Swap functionality between different AMMs and pools, but this also means higher transaction fees. However, to optimize transaction fees for users, Fibrous has designed a special mechanism to optimize fees during transactions.

Fibrous will look at the percentage of profit a user can make from a trade between two AMMs. If the return does not exceed the gas fees paid by the user, the protocol will not execute the transaction. This ensures that users only pay when it makes economic sense to them.

Sometimes, lower transactions don’t need to be split, and routing lower amounts can be unfavorable. This may not be preferred as each AMM applies a commission paid by you, and each route taken by Fibrous incurs a small gas fee. Even Fibrous is using a gas cost optimization algorithm to make sure every new step benefits your swap. In such a case, Fibrous offers the “Swap Cheapest” feature, especially for small trades. This feature is only for trading from the best liquidity pool in one go.

Specifically, Fibrous applies different fees for different types of swap transactions. For swaps between stablecoins, Fibrous will charge 0.02%, while other tokens will charge 0.15%. This helps users have a clear view of the fees they will have to pay when using the Fibrous protocol and can choose the transactions that suit their needs and priorities.

Conclusion

Fibrous is a promising protocol with many possibilities for future growth. Currently, the protocol has two main features: Swap between AMMs and Multi token inputs, enabling users to swap between different asset classes easily. However, the development team is still working hard to bring more new features. The goal of the protocol is to expand further access for wallet providers and dApps growing on the StarkNet platform. This is to achieve the most optimal swap rate, ensuring users have the best Fibrous experience.

Expanding access for wallet providers will be of great benefit to the user community. At the same time, supporting dApps developed on StarkNet will also open up new opportunities to take advantage of the protocol’s potential and increase interoperability between applications on the StarkNet platform.

With its continuous development and scalability, Fibrous could become one of the important protocols in the DeFi ecosystem. The growth and development of Fibrous can contribute to the popularity and use of DeFi on the StarkNet platform and help the platform become more and more powerful.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.