So, what exactly is iZUMi? What are the project’s standout outcomes? Let’s discover more about the project’s IZI token with Coincu.

What is iZUMi?

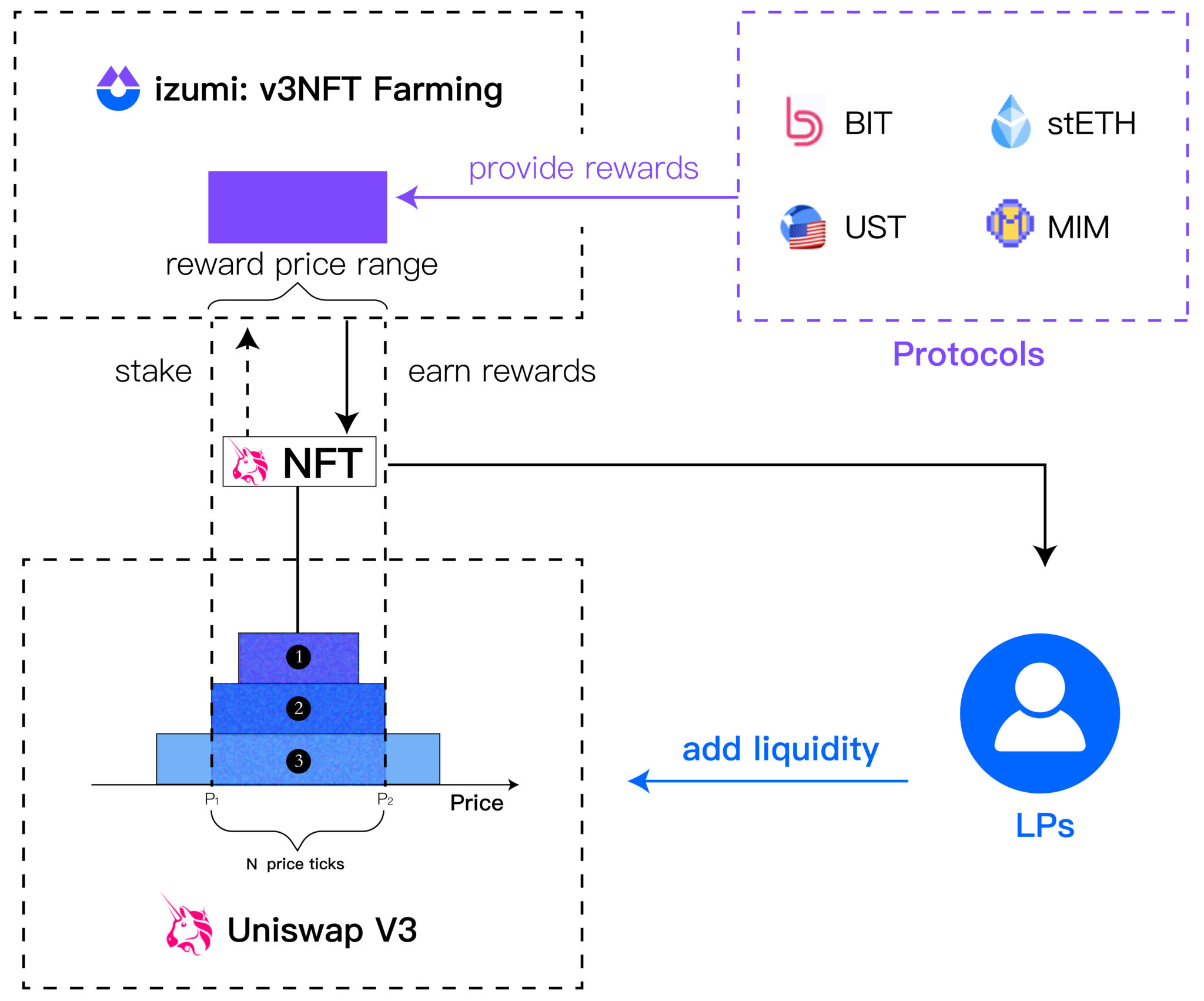

iZUMi Finance is a programmable LaaS platform built on top of Uniswap V3 and its built-in multi-chain DEX. In addition, iZUMi Finance presents novel liquidity mining procedures for successfully attracting liquidity by giving incentives within certain price ranges.

iZUMi Finance plans to extend its services to additional chains in the future, including DEX and Bridge connectivity. It will assist liquidity providers in earning more liquidity mining awards and trading fees on Uniswap V3.

iZUMi Finance uses Uniswap V3 to provide “Liquidity as a Service – LaaS” to tackle two problems: incentive inefficiency and pool 2 dilemma.

Moreover, it is the first effort to increase incentive efficiency by enabling “heterogeneous” Uniswap V3 liquidity mining and allowing protocols to apportion incentive payments across the broadest price ranges.

iZUMi overcomes the “pool 2 dilemma” by offering structured and auto-recovery incentive modules that may draw additional liquidity while maintaining a low emission rate for the protocol, while also permitting non-permanent liquidity mining for liquidity providers.

The iZUMi platform creates solutions with a focus on improving liquidity, such as iZiSwap, which allows users to trade tokens and participate in liquidity programs with LiquidBox…

On the other hand, this successful and long-term helps procedures attract additional liquidity. iZUMi Finance believes that all tokens in the cryptocurrency market need more liquidity.

Highlights

New DL-AMM Model

According to iZiSwap, the novel Discretized-Liquidity-AMM (DL-AMM) model outperforms the classic AMM model by 5,000 times (using the equation x*y=k).

The centralized liquidity element of the Uniswap V3 curve model is carried over to the DL-AMM. However, unlike Uniswap V3, DL-AMM divides the price curve into specific price points (as illustrated below), enabling liquidity to be supplied at any given price rather than a range.

As a consequence, users on iZiSwap may trade tokens swiftly and accurately, reducing slippage and avoiding front-run.

The DL-AMM model has the following advantages:

Various forms of liquidity provision

While engaging in liquidity mining schemes, LiquidBox gives consumers many alternatives, including the three types listed below:

- Fixed Range: A centralized liquidity provider for stablecoin and pegged-asset pairings.

- LiquidBox will immediately stake the UniSwap V3 NFT LP Token into the protocol after providing liquidity. This increases the predicted profit for users since they benefit from both the advantages of supplying liquidity from iZUMi and the protocol, as well as a portion of the income from transaction fees on Uniswap V3 (if the token price is still within the price range that LP set).

- When LP provides liquidity, the liquidity portion of the stablecoin or pegged asset is placed at the established price range, and the project token portion is staked in the LiquidBox module (not on Uniswap V3) to lock in liquidity, preventing the token from being sold automatically when the price breaks out of the set range. Helps consumers minimize the danger of temporary loss while lowering the project’s reliance on passive token sales.

Other benefits

- Farm safely: Maintain your ideals in Uniswap. Decentralized and non-custodial in nature.

- Simple to use: With a single click, you may deposit, zap, harvest, and withdraw.

- Earning a high APR: Stake to earn LP fees and other benefits for taking part in liquidity mining.

Services providing liquidity of iZUMi Finance

LaaS on Uniswap V3: LiquidBox

iZUMi Finance’s LiquidBox enables Uniswap v3 LP NFT to Programmable Liquidity Miners (LM), enabling protocols to precisely and effectively distribute incentives within certain price ranges, which may improve liquidity distribution and incentivize users to stake Uniswap V3 LP to earn greater rewards.

LiquidBox participants include:

- Liquidity Provider (LP): While providing liquidity on Uniswap V3, LPs will get NFT LP tokens reflecting their holdings, which they may put in iZUMi.

Protocols may actively specify the range for LP token payouts while participating in LiquidBox’s liquidity mining program. - LiquidBox will automatically decide if the LP’s NFT LP token value range is inside the protocol’s range. If this is the case, LPs will be compensated with LP tokens as compensation for providing liquidity.

LPs get an extra portion of the income from Uniswap V3 transaction fees, depending on the kind of liquidity provision.

Its LiquidBox technique is comparable to names like Tokemak or Mercurial in that the project transforms itself into a location to concentrate and pour liquidity where it is required. Exchanges, lending platforms, AMM, and other ventures may benefit from the ultimate liquidity.

To better comprehend LiquiBox, we will conduct a preliminary investigation into its mechanism of action, which will include the following steps:

- Step 1: Projects will contact iZUMi Finance to seek $10,000 in liquidity and offer certain details, such as the price range of liquidity provision, the date of the event, and the number of tokens utilized to provide incentives.

- Step 2: If the pool is successful, iZUMi Finance will deploy it on its platform.

- Step 3: On Uniswap V3, the user supplies liquidity and gets an NFT reflecting that liquidity.

- Step 4: The user will enter the NFT into the iZUMi Finance protocol.

- Step 5: The protocol examines the price at which users give liquidity on Uniswap V3 and adjusts if the price is out of range.

That is the aim, and here is how LiquidBox implements a liquidity bootstrap event for a token that is launching a native token first.

Separate liquidity AMM across multiple chains: iZiSwap

iZiSwap was originally implemented on the BNB Chain network and is what iZUMi Finance refers to as a Discretized – Liquidity – AMM with the capacity to provide about 5000 times greater capital efficiency than typical AMM models utilizing the formula x * y = k.

In essence, Discretized – Liquidity – AMM is a comparable AMM to what Uniswap V3 accomplished, however, instead of Uniswap V3, LPs set price ranges to supply liquidity using iZiSwap. Then, similar to Trader Joe’s Liquidity Book, the LPs will supply liquidity at predetermined prices.

Uniswap V3 and other centralized liquidity services should be extended across numerous chains. To boost capital efficiency across several chains, iZiSwap will allow limited orders and be compatible with orderbook and Uniswap V3.

iZiSwap has the following features:

- Swap: Immediate transactions at precise prices, without slippage or front-running.

- Limit Order: A limit order is an order to exchange tokens at a certain price.

- Pro Trading: With the Pro Trading interface, iZiSwap delivers a CEX-like trading experience, letting users make orders to buy and sell tokens on the order book (Order-book).

- Liquidity: Provides centralized liquidity in a price range and is rewarded with trading fees.

- Campaign: Participate in iZiSwap events to get incentives.

- Analytics: This page gives an overview of iZiSwap statistics, such as TVL, trading volume, liquidity pool, top tokens, transaction details, and so on.

Centralized liquidity service on the bridge: C-AMM Bridge

Cross-chain bridges that are fast, decentralized, and self-balancing are critical in the multi-chain age.

The C-AMM Bridge from iZUMi will execute cross-chain transactions in under a minute and with reduced gas expenses. Multi-confirmation relay networks, which are decentralized and entirely transparent, will assure cross-chain security.

The following are the main characteristics of the iZUMi C-AMM Bridge:

- Cross-chain liquidity swap: The user experience will be similar to contributing USDC to ChainA’s reserve pool and then getting USDC from ChainB’s reserve pool. It should be emphasized that the transmitted USDC is not a bridge-wrapped token but rather a legally issued token.

- Multi-validator Relay Network: The data in each block is read by several validators on the Relay Network. When they discover transactions related to the reserve pool on either side of the bridge, they vote to establish a consensus and then transmit the multisig transaction to the other side.

- Concentrated-liquidity AMM

The iZUMi Bond (iUSD)

The iZUMi Bond (or iUSD, iZUMi Bond USD) is a 100% collateral and project revenue-backed bond issued by iZUMi Finance.

The iUSD is tied to the USD at a 1:1 ratio.

In a private financing round, iZUMi Finance offers iUSDs to investors in order to raise cash for the future growth of the iZUMi ecosystem.

Uzumi Finance is the pioneer in the issuance of convertible bonds in the form of stablecoins. The principle of operation is relatively simple: users will pay ETH or BIT to purchase iZUMi Finance bonds in the form of iUSD stablecoins, which will subsequently be converted into the project’s native token IZI at a discount of IZI.

Uzumi Finance collaborates with the Solv Protocol project to create stablecoin convertible bonds.

Impermanent Loss (IL) Insurance

The Uzumi Finance platform, when combined with derivative protocols, may assist LPs in avoiding Impermant Loss while providing liquidity on the AMM protocols that the project supports.

Dual Currency Product

This is a tool that assists consumers in maximizing their earnings both now and in the future if the market is in a strong rise.

Fixed Income Product

iZUMi Finance may pay a set APR of up to 10% within 30 days for investors by engaging in fascinating DeFi activities such as lending and borrowing, trading, farming, staking, and so on.

veiZi

veiZi (iZUMi DAO veNFT) is iZUMi Finance’s governance token in the form of an NFT that adheres to the ERC-721 standard.

veiZi may be used to do the following:

- Voting: Take part in voting on governance issues in the iZUMi DAO.

- Staking: 50% of iZUMi’s monthly earnings will be utilized to redeem IZI tokens and distribute them as staking incentives to veiZi holders.

- Boosting: Holding veiZi is seen as a kind of NFT staking on LiquidBox, which boosts the APR of pools by up to 2.5 times.

Users must lock IZI tokens for a certain length of time in order to mint veiZi (at least 7 days and maximum 4 years). The more veiZi you get, the longer the IZI lock time.

IZI token

Key Metrics

- Token name: iZUMi Finance token

- Ticker: IZI

- Token Standard: ERC-20

- Blockchain: Ethereum, BNB Chain, Polygon, Arbitrum, zkSync Era

- Token contract:

- Ethereum: 0x9ad37205d608B8b219e6a2573f922094CEc5c200

- BNB Chain: 0x60D01EC2D5E98Ac51C8B4cF84DfCCE98D527c747

- Polygon: 0x60D01EC2D5E98Ac51C8B4cF84DfCCE98D527c747

- Arbitrum: 0x60D01EC2D5E98Ac51C8B4cF84DfCCE98D527c747

- zkSync Era: 0x16A9494e257703797D747540f01683952547EE5b

- Token Type: Utility

- Token Supply: 2,000,000,000 IZI

Token Allocation

- Ecosystem: 55% (1,100,000,000 IZI)

- Team: 18% (360,000,000 IZI)

- Private Round: 15% (300,000,000 IZI)

- Partnership: 10% (200,000,000 IZI)

- IDO/IEO: 1% (20,000,000 IZI tokens)

- Airdrop: 1% (20,000,000 IZI).

Release Schedule

- Team: Pay 10% after 6 months from the token listing date, then pay monthly for 18 months.

- Ecosystem: Pay 3% initial token in Uniswap V3, then pay the rest in the next 4 years.

- Private Round: Pay 10% on the token listing date, continue to lock for 3 months, and then pay in installments over the next 12 months.

- Partnership: Pay 10% after 6 months from the token listing date, then pay monthly for 18 months.

- IDO/IEO: Pay off immediately after token listing.

- Airdrop: Pay immediately after token listing, exclusively for marketing campaigns.

Use Case

The iZUMi Finance platform’s utility token, iZi token, may be used to pay cross-chain transaction fees, set up incentive groups, and utilize other capabilities.

Moreover, users must stake iZi tokens to receive the ve-iZi token, which is the iZUMi Finance platform’s governance token, allowing holders to qualify for a variety of perks and participate in platform governance.

ve-iZi is neither transferrable nor traded, and it can only be obtained by staking iZi.

Roadmap

Currently, the project has not announced a new development schedule.

Investors & Partners

Investors

After three rounds of investment, iZUMi Finance has raised a total of $27.6 million. Rounds of financing information:

- Seed Round (November 10, 2021): Mirana Ventures led the $2.1 million round, including participation from Youbi Capital and Everest Ventures Group.

- Series A round (December 9, 2021): $3.5 million raised, including participation from Gate Laboratories, GSR Ventures, IOSG Ventures, MEXC Global, Mirana Ventures, and others.

- Venture Round (April 21, 2023): Unicode Digital, NextGen Digital Venture, Incuba Alpha, Bella Protocol, and others participated in the $22 million round.

In the most recent funding round, the project wants to develop a decentralized OderBook called iZiSwap Pro on the zkSync Era network.

Partners

Conclusion

iZUMi Finance is the first protocol to offer Uniswap V3 liquidity mining, allowing multi-chain users to benefit from centralized liquidity services.

We are certain that the IZI token is a suitable long-term investment since iZUMi Finance answers existing issues with Uniswap v3. In addition to supporting one of the most prominent DEXs in the crypto market, the iZi token has other utility properties, making it a good investment.

One thing to keep in mind is that ve-iZi tokens are neither marketable nor transferable and can only be gained by staking iZi tokens, with ve-iZi acquired coins equaling the staked iZi tokens. This eventually improves the iZi tokens’ long-term worth since users are motivated to stake them and enjoy the benefit that comes with the ve-iZi token.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.