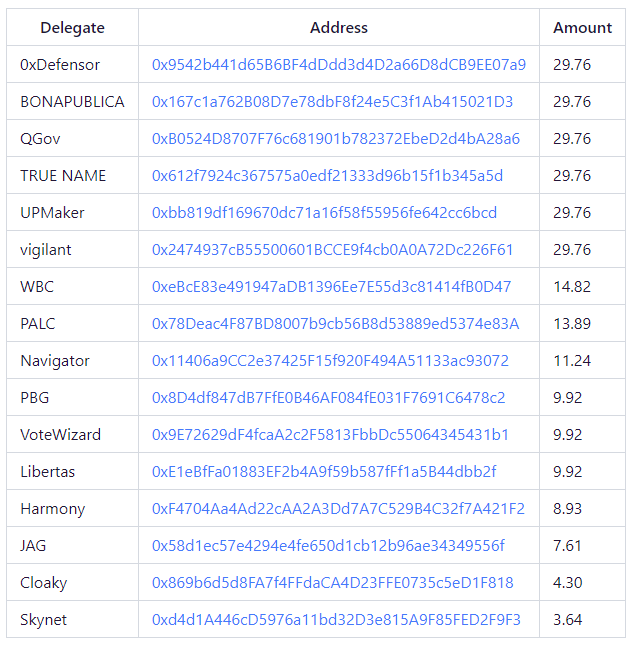

These decisions center around a slew of regulatory proposals pertaining to the Emergency DAI Savings Rate (EDSR) and stability fees.

At the heart of these proposals lies a transformational modification to the Dai Savings Rate (DSR). If the proposals successfully garner approval, the DSR is poised to undergo a noteworthy reduction, in alignment with the latest updates of the Advanced DAI Savings Rate (EDSR). This adjustment would see the DSR sliding from its current 8% mark to a more conservative 5%, a move that holds the potential to catalyze shifts in the financial dynamics of the MakerDAO ecosystem.

Further delving into the intricacies of the proposals, the spotlight falls on an array of stable fees encompassing assets such as ETH, wstETH, and rETH. This comprehensive approach to fee adjustments speaks to MakerDAO’s commitment to fine-tune the economic model of its decentralized system, aiming to achieve a balance between sustainability and accessibility.

Notably, the regulatory overhaul extends beyond interest rates and stable fees. The proposals also encompass the revamp of parameters within the smart destruction engine, a critical component in maintaining the stability and value of the ecosystem’s native token.

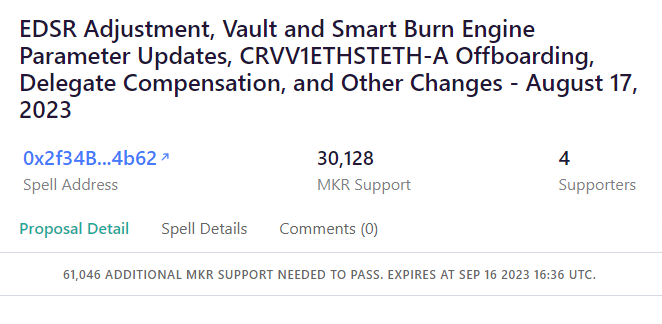

As the crypto community eagerly watches the unfolding of these developments, the voting process has been set in motion, with a scheduled closure on September 16th. This timeline reflects MakerDAO’s commitment to inclusivity and consensus-building, ensuring that all stakeholders have the opportunity to contribute to shaping the platform’s trajectory.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.