- DeFi TVL has more than doubled in the last five months.

- The growth this time was primarily led by liquid staking projects.

After entailing significant losses during the bear market, the decentralized finance (DeFi) ecosystem was booming with activity as of this writing.

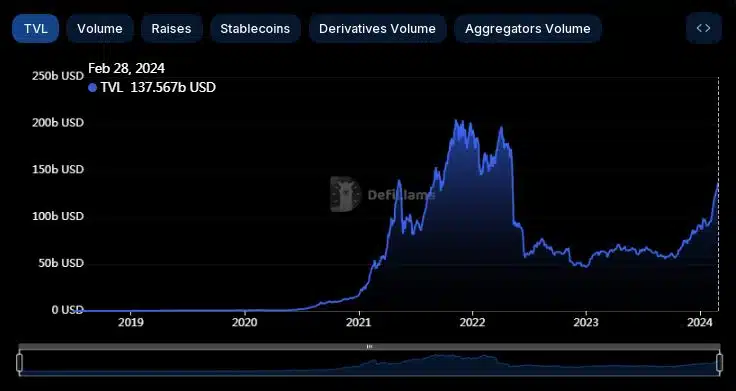

The total value locked, the barometer of the DeFi market’s overall health, topped $137 billion as of this writing, less than 3% short of its May 2021 highs, according to AMBCrypto’s analysis of DeFiLlama’s data.

While the value of the current deposits was still some way off from the peak recorded in November 2021, the upward trajectory elevated the prospect of a breach sooner or later.

The story of recovery

The emergence of blockchain technologies, the narrative around decentralization, and the historic crypto bull market of 2020-21, played a big part in turbocharging the DeFi economy.

As evident in the graph above, the total amount of cryptocurrency assets locked in DeFi protocols ballooned 100x from the period between June 2020 to July 2020.

The TVL continued to surge as the market value of crypto assets hit ATH later in 2021.

However, events such as stablecoin Terra USD’s [UST] collapse and the downfall of the FTX [FTT] exchange plunged the broader market into a crisis, impacting investments in DeFi protocols.

The TVL tanked to $48 billion in December 2o22, 75% below its ATH.

The DeFi market showed signs of recovery in 2023 as TVL rose 25% until Q3. But the major lift happened from October onwards, as leading crypto coins began their upward march.

Since then, DeFi TVL has more than doubled as of this writing.

New narratives take center stage

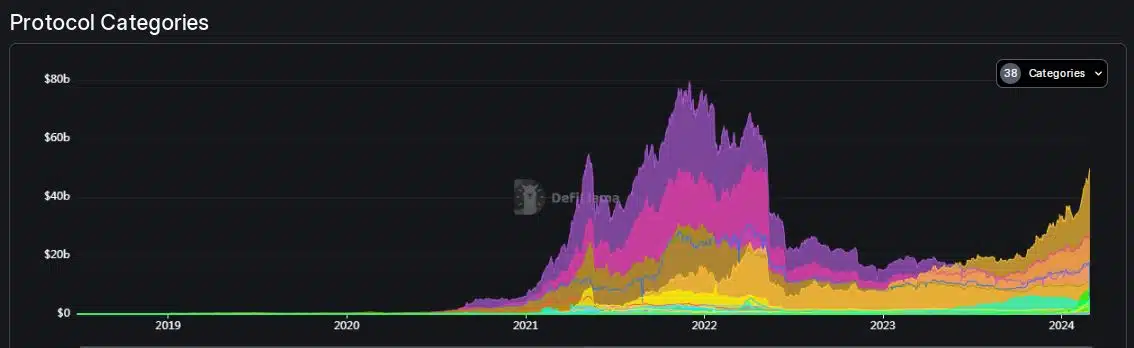

As noted by prominent DeFi analyst Patrick Scott, the growth this time was primarily led by liquid staking projects, as opposed to decentralized exchanges (DEXes) which catalyzed growth during 2021.

Indeed, DEXes, which facilitate the swapping of crypto tokens in a decentralized setup, accounted for 37% of the total market share in November 2021. As of this writing, they made up just 13% of the total DeFi TVL.

In contrast, liquid staking protocols emerged as the largest sub-sector in the DeFi landscape over the past year, with a market dominance of 34% at press time.

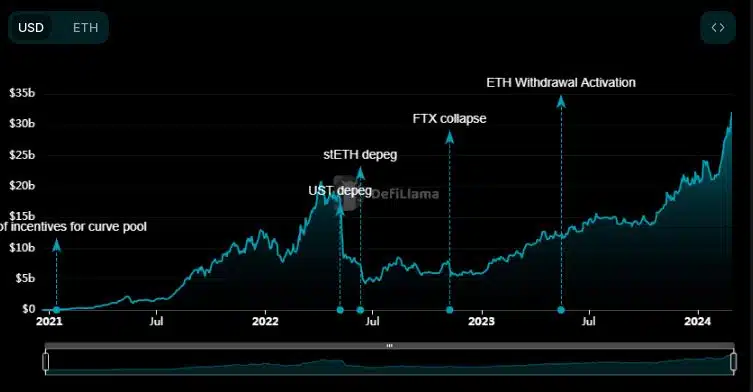

Ethereum [ETH] liquid staking project Lido Finance [LDO] was the biggest DeFi protocol, with nearly $33 billion worth of assets locked at press time.

Liquid staking allows users to directly participate in staking while also having the option to employ them elsewhere in DeFi for higher yield opportunities.

The launch of Ethereum’s Shapella Upgrade last year reinvigorated demand for ETH staking, and in turn liquid staking projects.

Note how Lido’s deposits have more than doubled since Shapella Upgrade enabled withdrawals in April last year.

Moreover, since most of Lido’s deposits are staked ETH, the surge in the market value of the latter has contributed to the TVL rise.

Lido’s TVL jumped by 45% in the last month, proportional to ETH’s price rise.

The newest star on the block

Staking also got a big boost from restaking protocols, one of the fastest-growing DeFi narratives. EigenLayer was the fourth-largest DeFi protocol at press time, witnessing a fourfold spike in TVL in the last month.

Restaking involves reusing staked ETH to extend security to other applications, thus allowing stakers to earn extra rewards on their investments.

Since rewards through conventional ETH staking have reduced over time, the promise of higher returns brought users to these restaking projects.

The bear market may have been a difficult time for investment and value, but the reduced noise made developers build products aligning with their long-term growth plans.

As the cryptocurrency market grows in size, the demand for DeFi projects is bound to grow. So, 2024 might just be the beginning of the DeFi super cycle.