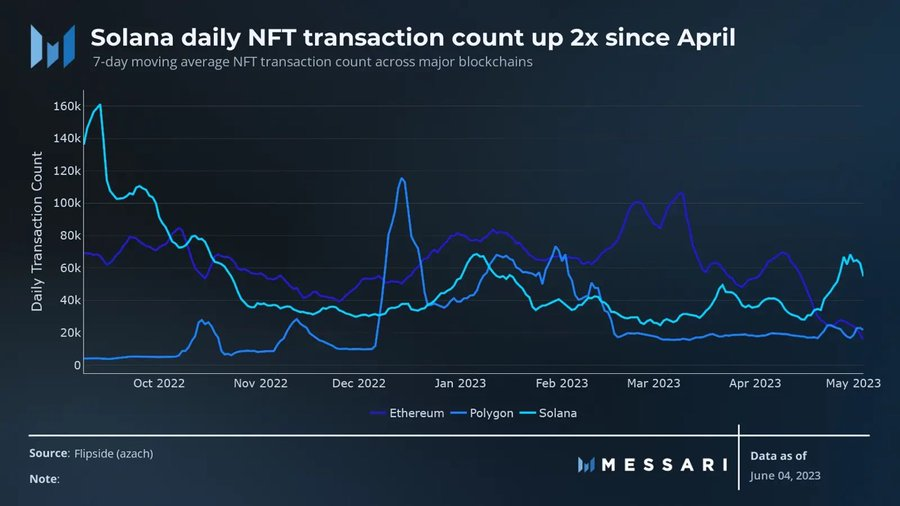

The crypto research and analytics platform Messari shared a post on Twitter earlier today sharing that Solana (SOL) has experienced a notable increase in its daily NFT transactions. According to the post, Solana’s NFT transactions have doubled over the past 30 days alone.

Solana daily NFT transaction count (Source: Twitter)

Messari added in the post that Solana’s NFT success can be attributed to heightened activity with consumer apps. As a result of this, Solana was even able to surpass both Ethereum (ETH) and Polygon (MATIC) in terms of NFT transaction volume.

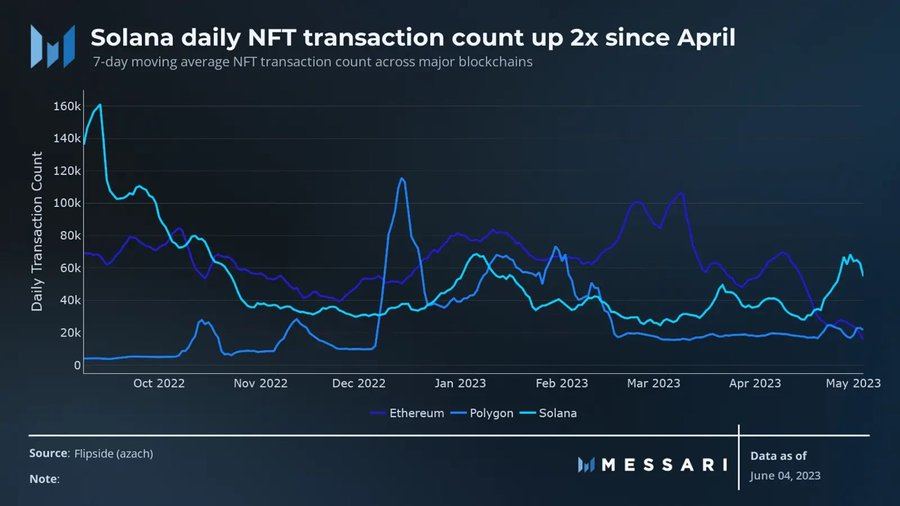

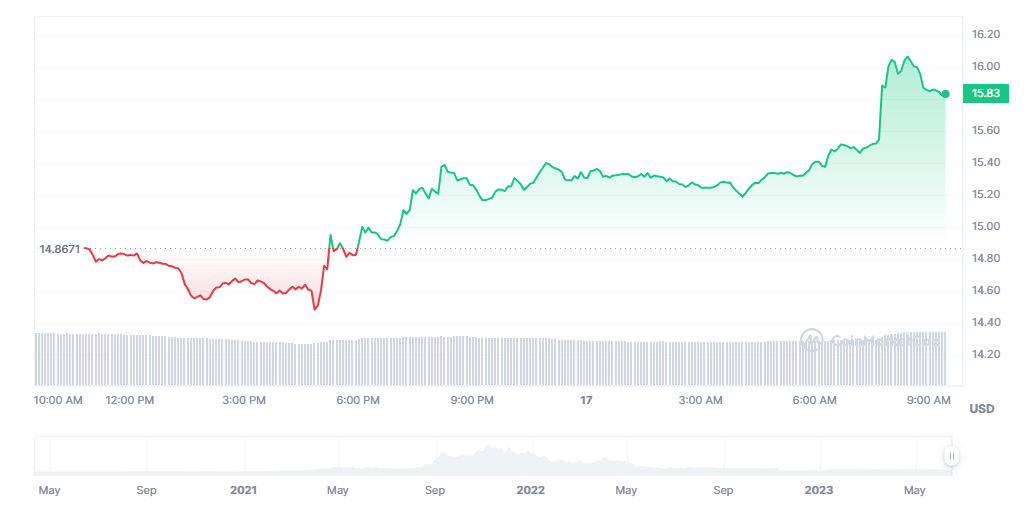

Solana’s success in the NFT space was accompanied by a decent increase in the altcoin’s price over the past 24 hours of trading. The crypto market tracking platform, CoinMarketCap, indicated that SOL was trading hands at $15.85 after the crypto saw a more than 6% price rise over the past day.

SOL price (Source: CoinMarketCap)

This increase in price was enough to push SOL’s Price weekly performance even further into the green despite a tough week in the market. At press time, SOL was up about 13.07% over the past seven days.

It is also worth taking note that the price of SOL was still able to climb despite the fact that New York-based digital assets platform Bakkt decided to delist SOL, MATIC, and ADA. This came in response to regulatory uncertainty and recent SEC lawsuits against multiple crypto exchanges.

In related news, SOL was unable to reclaim the number 9 spot on CoinMarketCap’s largest crypto projects in terms of market cap. The Ethereum-killer lost the spot to TRON (TRX) over the past week. There is still, however, a chance that SOL is able to reclaim the position back from TRX in the coming few weeks.

At press time, SOL’s market cap was estimated to be around $6.137 billion. Meanwhile, TRX’s market cap stood at approximately $6.406 billion. The margin between the two market caps decreased over the past 24 hours as TRX was only able to print a 1.62% gain over the past 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.