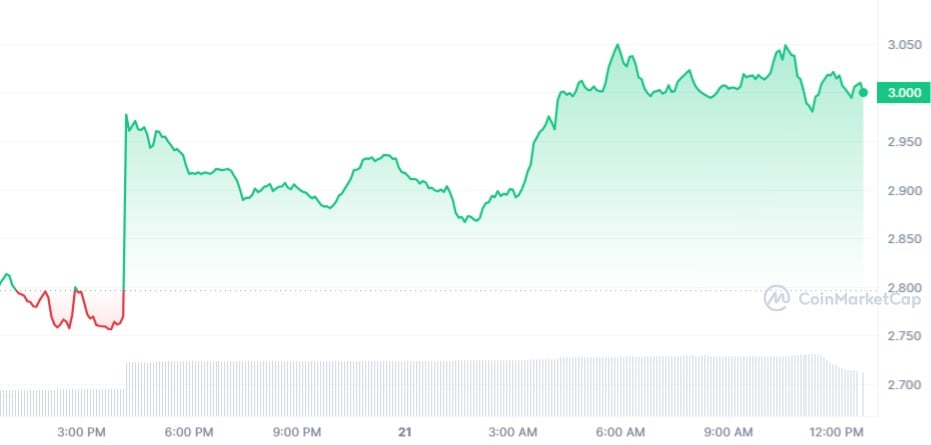

Synthetix (SNX) is one of the altcoins leading the bullish run on the market today after recording massive 10% growth over the past 24 hours to $3. Based on the current performance outlook, Synthetix is now up by more than 16% in the week-to-date (WTD) period.

Synthetix occupies a defined niche in the decentralized finance (DeFi) ecosystem. The protocol is designed as a decentralized liquidity provisioning protocol that any outfit requiring its locked liquidity can tap into for various purposes. The deep liquidity being maintained by Synthetix, accompanied by its low fees, serves as a backend for some of the most popular protocols in the industry, including the duo of Optimism and Ethereum.

Synthetix, over the past few months, has shown how formidable it is as a protocol, set to retest its previous highs. Prior to the long-drawn-out crypto winter, SNX recorded an all-time high (ATH) of $28.77. Per its current price action, the cryptocurrency is still down as much as 89.5%, a bearish indicator showing the possibility of a massive upside soon.

The bullish trading volume is up by more than 77.56% over the past 24 hours, a showcase that the token is being gobbled up by retail investors, among others.

Consistency is the Synthetix mantra

There have been a number of hurdles in the broader digital currency ecosystem thus far this year, with regulatory crackdown on exchanges by the United States Securities and Exchange Commission (SEC) taking center stage. This centralized exchange crackdown has paved the way for Synthetix through some of the CEX competitors it is bootstrapping.

Amid the uncertainty, Synthetix has remained consistent in its growth upsurge, as frequently reported by U.Today. The SNX token has been beating crucial DeFi milestones over the past few months and is primed to retest its 52-week high of $4.39.