Decentralized Finance (DeFi) has emerged as a disruptive force in the financial industry, offering transparency and financial inclusion.

A significant trend within DeFi is the increasing trading volume on Decentralized Exchanges (DEXes) compared to Centralized Exchanges (CEXes).

DeFi has revolutionized traditional finance by leveraging blockchain technology. DeFi protocols facilitate peer-to-peer transactions, lending, and other financial activities without intermediaries.

The decentralized nature of DeFi offers advantages such as transparency and security, leading to its rapid growth.

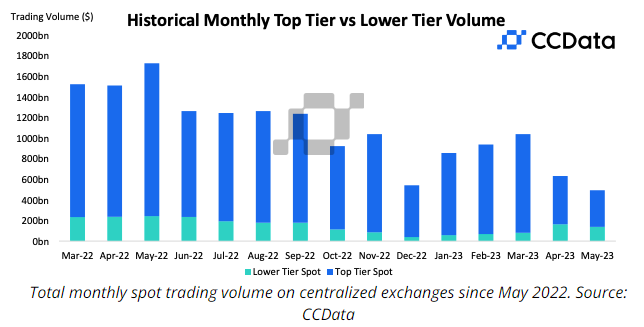

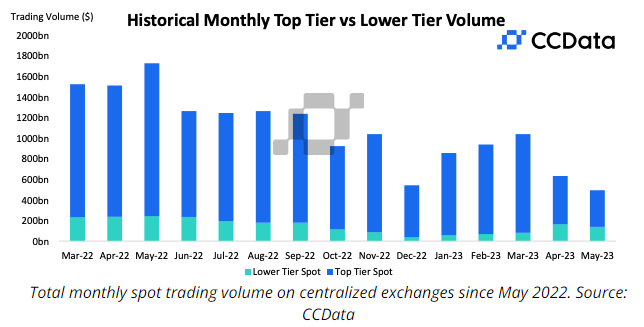

Declining Spot Volume on Centralized Exchanges (CEXes)

When it comes to trading cryptocurrencies, CEXs have typically been the most popular venues, but DeFi has made it possible for consumers to access other markets.

As the price of crypto assets remained mainly range bound and volatility decreased to levels not seen since the beginning of the year, the total spot and derivatives trading volume on centralised exchanges dropped 15.7% to $2.41tn in May, registering the second straight loss in monthly trading volume.

The decrease in spot volume on CEXs might be attributed to a number of different variables. Users like the control and security that DEXes offer, since the latter provide them ownership of their money and control over how they are used.

In addition, DEXs function in a trustless setting, which eliminates the need to rely on centralized organizations.

Additionally, regulatory worries connected with CEXes and the allure of borderless and permissionless trading on DEXes contribute to the dropping spot volume on CEXes. DEXes also play a role in the trading of cryptocurrencies.

DEXes have experienced significant growth due to several factors.

The use of Automated Market Makers (AMMs) and liquidity pools enables decentralized trading on DEXes, attracting users with better trading opportunities and reduced slippage.

DEXes also have lower barriers to entry, as they do not require lengthy registration processes or KYC procedures. The wide range of tokens and investment opportunities available on DEXes appeals to traders seeking innovation beyond mainstream cryptocurrencies.

Implications and Future Outlook

The paradigm change in the financial environment is shown by the fact that DEXs are becoming more dominant in terms of trading volume.

It is anticipated that more development and expansion will occur as more users become aware of the advantages of DeFi.

However, in order to facilitate the widespread adoption of decentralized banking and its integration with conventional financial systems, a number of obstacles, including scalability, user experience, and regulatory concerns, need to be overcome.

Conclusion

The increasing relevance of decentralized finance is shown by the dropping spot volume on centralized exchanges (CEXes) and the rising usage of decentralized exchanges (DEXes).

A significant percentage of the trading volume has shifted away from centralized exchanges and toward DeFi as a result of the benefits that it offers in terms of control, security, and innovation.

It is possible that, if the DeFi ecosystem continues to develop and find solutions to problems, it will have the capacity to revolutionize the financial sector by providing an alternative that is more inclusive and efficient than existing financial institutions.