A trader who accurately called the end of Bitcoin’s (BTC) 2021 bull market thinks that the crypto king will once again meteorically rise due to the inevitable return of money printing.

Pseudonymous analyst Pentoshi tells his 702,300 followers on the social media platform X that it’s only a matter of time before the US government turns on the money printers again.

According to Pentoshi, Bitcoin will begin its parabolic surge once the US government decides to debase the dollar to pay off its massive debt burden to the tune of $33.523 trillion.

“When the printers come back to inflate away debt, and they will and always have. Just remember, BTC is fundamentally the hardest asset in the world with both a programmatic monetary policy and fixed supply. There’s always another cycle.”

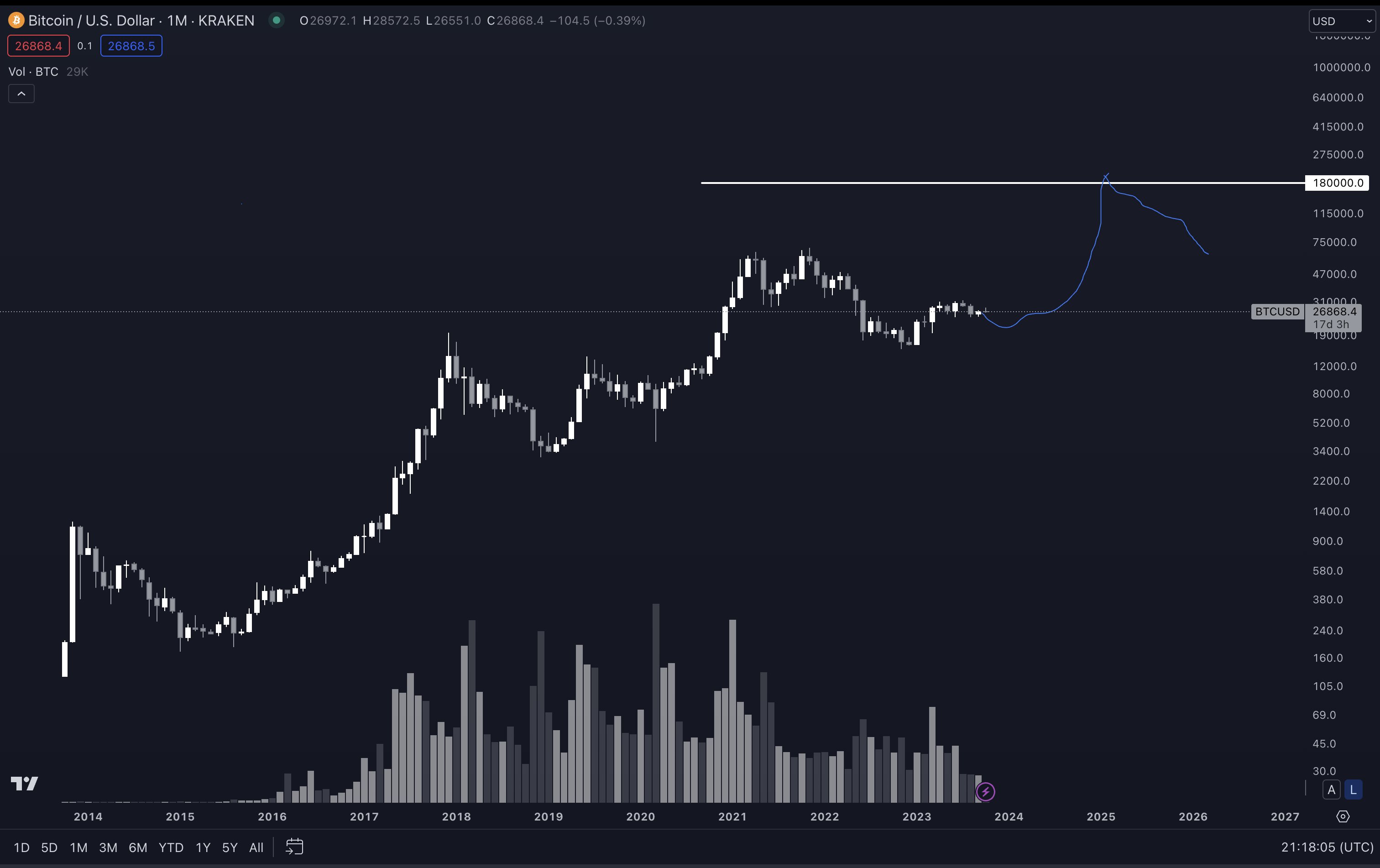

Looking at the trader’s chart, he sees Bitcoin rallying to a new all-time high of $180,000, suggesting a move of about 570% from current prices.

While Pentoshi believes that there will be another bull cycle for Bitcoin, he says that it is unclear when the Fed will start cutting rates.

“Really have no way of knowing when tightening will end, and it can extend for years. Or we can just end up in years of stagflation.”

The crypto strategist is also keeping a close watch on the chart of Bitcoin versus M2 money supply. M2 is a global liquidity indicator as it takes into account the amount of liquid money moving around the system. Crypto traders like Pentoshi believe that Bitcoin tends to ignite a bull market when M2 or global liquidity is on the up and up.

The analyst shares a chart showing that Bitcoin versus M2 appears to be gearing up for a big breakout.

At time of writing, Bitcoin is trading for $27,855.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney