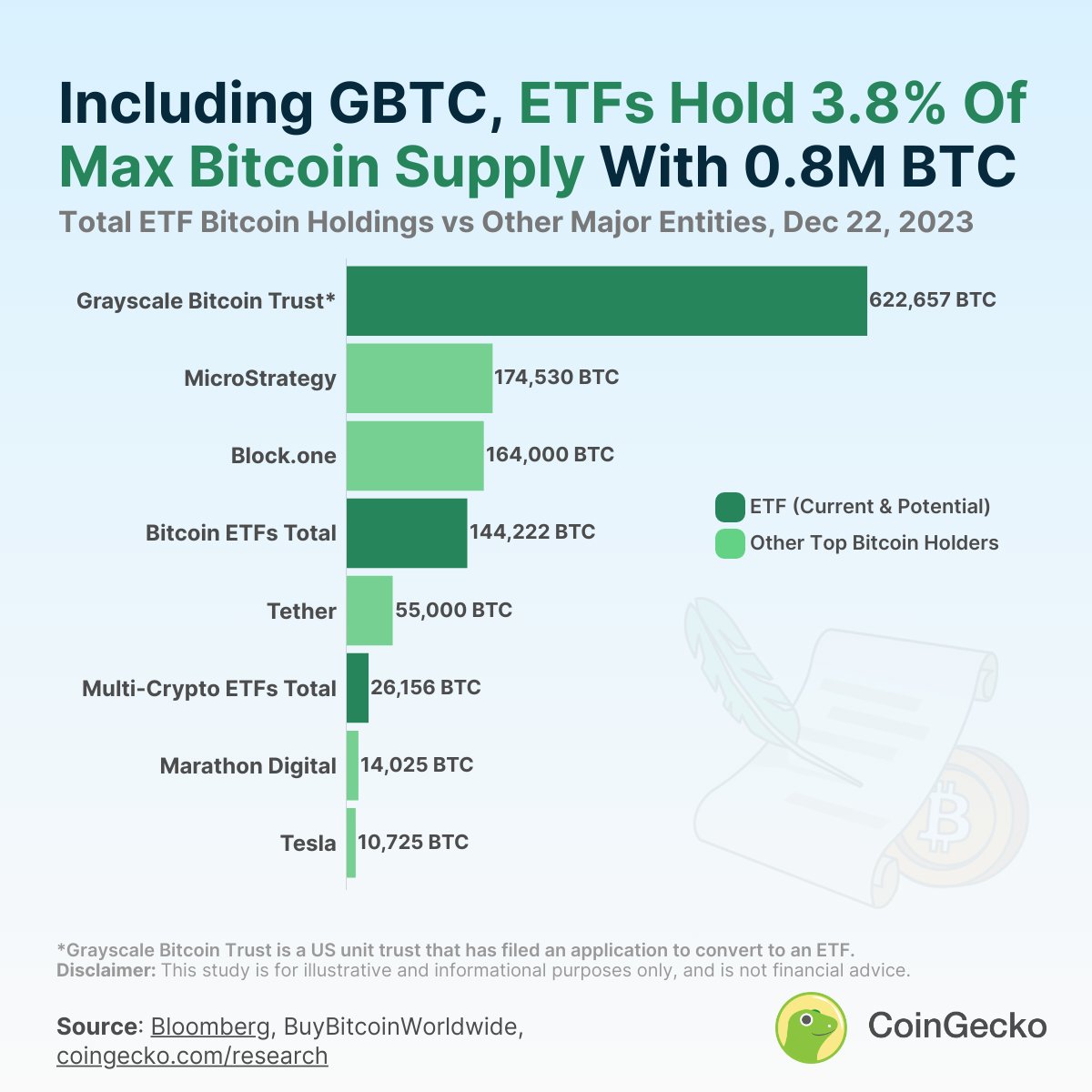

Bitcoin (BTC) exchange-traded funds (ETFs) currently only represent a small fraction of the top crypto asset’s supply, according to a CoinGecko researcher.

In a new analysis, Lim Yu Qian notes that Bitcoin ETFs hold a total of roughly 793,034 BTC, which represents only 3.4% of BTC’s total maximum supply.

That number includes Grayscale Bitcoin Trust (GBTC). Grayscale is currently awaiting a decision from the U.S. Securities and Exchange Commission (SEC) on an application to convert its trust into a spot BTC ETF.

Without Grayscale’s product in the mix, Bitcoin ETFs represent only 0.8% of the top crypto asset’s maximum supply, according to Yu Qian.

Explains the CoinGecko researcher,

“While ETF providers control only a minority supply of Bitcoin currently, US approval of spot Bitcoin ETFs is expected to drive up investor demand. It remains to be seen whether traditional financial institutions will have an outsized influence over Bitcoin in the future.”

James Seyffart, an ETF research analyst at Bloomberg Intelligence, predicts that the first spot BTC ETFs will be approved next month.

Last week, Bitwise, the world’s largest crypto index fund manager, released a commercial for a spot Bitcoin ETF in apparent anticipation of the product’s regulatory approval. Bitwise is one of a slew of firms that have filed for a spot BTC ETF with the SEC.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney