The rapid increase in popularity of the LSDFi protocol can be attributed to its ability to address critical weaknesses in the DeFi sector. LSDFi offers users enhanced flexibility and capital efficiency by combining liquidity sensitivity with derivative farming. Investors are flocking to the protocol, realizing its potential to optimize their earnings while minimizing the risks associated with decentralized finance.

As the DeFi landscape continues to evolve, the growing prominence of LSDFi highlights the ever-increasing need for sophisticated yield farming options. $25 million in single-day inflows hitting a record high for the protocol demonstrates a strong belief in its potential for long-term success. It is anticipated that LSDFi will continue to attract both seasoned DeFi enthusiasts and new investors looking for innovative ways to maximize their returns.

What is LSDFi?

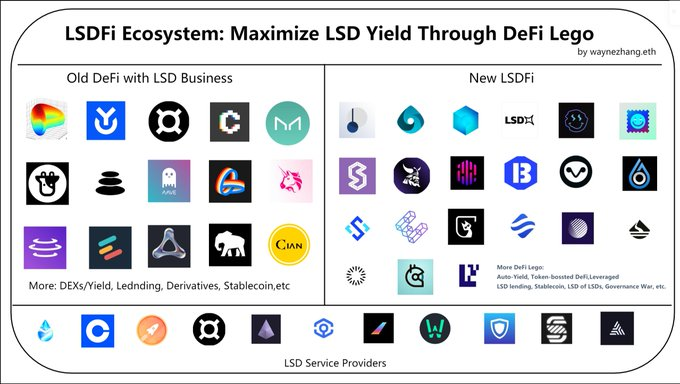

LSDfi refers to a set of protocols based on LSD. It covers many projects, ranging in capabilities from classic DEXs and lending protocols to more complex protocols built using unique LST properties.

With the widespread adoption of LSD, these protocols will play an essential role in DeFi, laying the foundation for the DeFi ecosystem, while projects building more complex products on top of LSD will be at the next layer.

LSD has become the dominant category in TVL Locked Total Value, with Lido being one of the most significant projects. Not only that, LSD has become a standard in any Proof-of-Stake (PoS) ecosystem and has been one of the important trends in DeFi. LSD provides a consistent, low-risk source of passive income and contributes to the maintenance of the blockchain.

Therefore, LSD plays an essential role in driving the growth of the entire DeFi ecosystem. LSDfi serves as a logical extension of LSD, generating economy as an whole that generates substantial income while simplifying interactions with LSD projects.

The total locked value (TVL) of LSDFi exceeds $396 million. This proves that the integration of DeFi and the LSD industry is a significant trend and LSDfi is the result of this evolution. As this trend develops, LSD is becoming one of the main forces in DeFi. Currently, LSDfi has grown into an independent field in DeFi and is making positive strides. It includes classic DeFi protocols and more complex protocols like Basket Protocol, Stablecoins, Profit Strategy, and more.

Top 6 LSDFi projects to look forward to

Lybra Finance(LBR)

The appeal of Lybra Finance is that it allows holders to receive stablecoin $eUSD automatically bearing 7.2% APY interest in real-time. It will give you a stablecoin and it will multiply in your wallet as long as you hold it.

To mint $eUSD, you need to deposit ETH or stETH, and the protocol distributes the proceeds generated by stETH to $eUSD holders. In other words, by depositing ETH or stETH into the protocol and minting $eUSD, you can earn about 8.3% APY.

Due to the recent popularity of Lybra Finance on Twitter, the price of $LBR has skyrocketed, and it is also attracting more and more people to receive rewards by minting $eUSD.

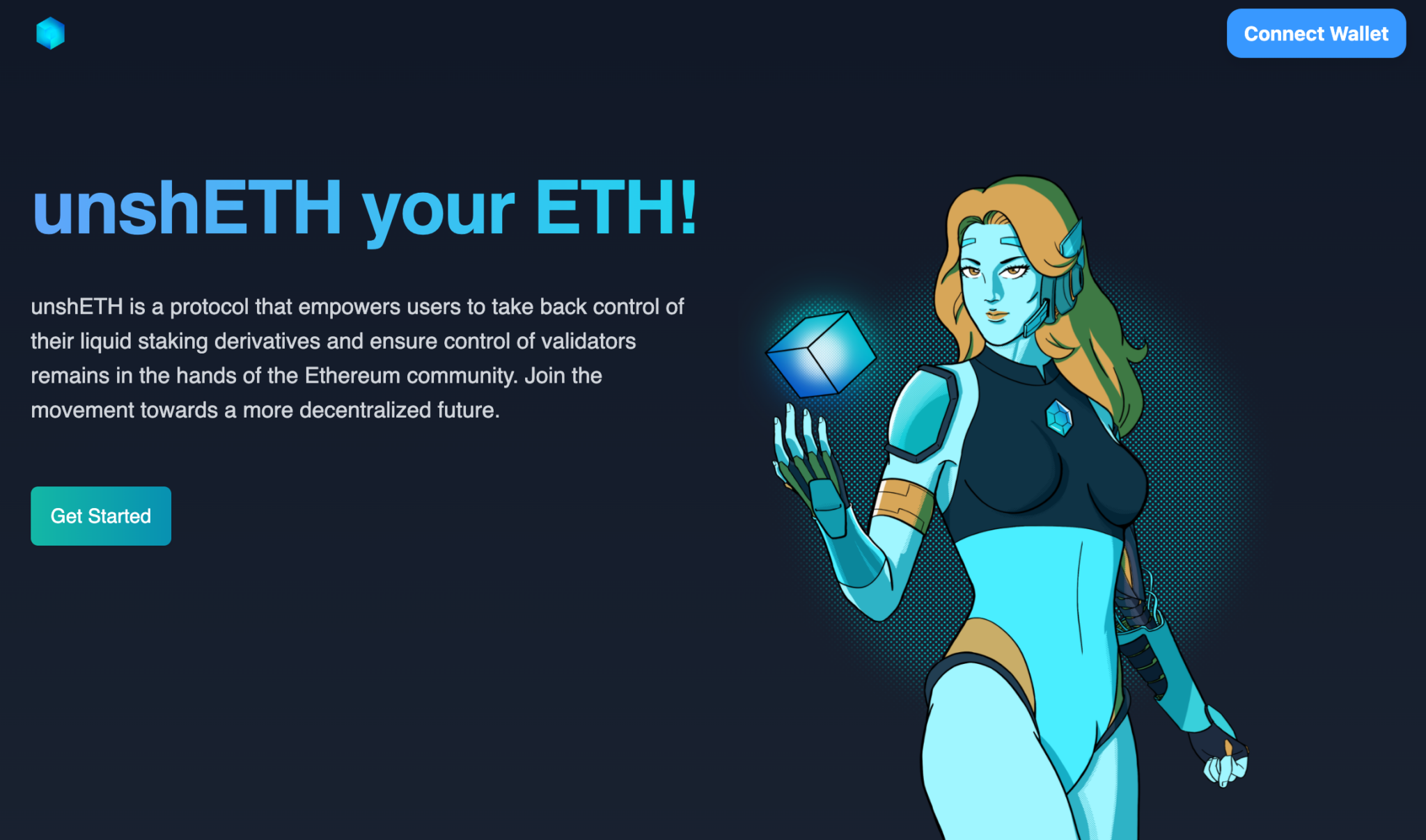

unshETH (USH)

unshETH is a decentralized, on-chain movement to improve validator decentralization. The matrix prevents monopolies from growing so large that it stifles innovation and jeopardizes the economy by becoming a central point of failure through the creation and enforcement of antitrust laws.

UnshETH’s mission is simple – decentralization through incentives. Through incentive engineering, UnshETH aims to distribute capital across the LSD ecosystem in a way that prioritizes the decentralization of validators.

unshETH is more profitable for smaller validators, and Bettors get higher yields, and ETH is more decentralized. Think of it as a decentralized preferred profit aggregator.

Pendle (PENDLE)

Recently, Pendle’s TVL hit an all-time high of nearly $100 million. Pendle’s idea is to allow users to use their assets and earnings separately.

In Pendle, the profit asset is divided into Master Token (PT) and Profit Token (YT). PT represents the principal of the yielding investment and YT represents the yield of the yielding asset. YT and PT can be traded on Pendle AMM.

For example, sending 1 stETH will generate 1 PT-stETH and 1 YT-stETH, where, 1PT-stETH can be exchanged for 1 stETH and 1 YT-stETH can allow you to receive 1 ETH (stETH) when depositing into Lido All the proceeds.

If you are a low-risk investor pursuing stability, you can buy PT with income removed for a fixed income; if you are an interest-rate trader and think an asset could go up in price, you can buy YT.

0xAcid (ACID)

0xACID is a protocol that aims to maximize the return of LSD assets (such as stETH, rETH, frxETH, etc.) at 4-5% APR. It will significantly impact the entire Ethereum L1 and L2 with the rise of the treasury’s ETH-related assets.

The protocol holds LSD-related assets (equivalent to the long-term upside potential of ETH) and continuously earns real income from Ethereum nodes. All protocol values are in ETH, focusing on ETH growth only, as we firmly believe ETH will reach above $10,000 in the near future. The treasury will liquidate ETH when it comes $10,000 and ACID holders will receive a massive profit in USD.

Gravita Finance (GRAI)

Gravita Finance is an interest-free lending arrangement with LST as collateral, much like the LSDFi version of Liquity Protocol.

After collateralizing ETH in LSD protocol to receive rETH, wstETH and other LST, deposit it in Gravita, and in return, you can get stablecoin GRAI. The GRAI stablecoin can also be loaned through Graivta for consumption or deposited into the stablecoin fund to purchase liquidated LST collateral at a discounted price.

If the user repays the loan within six months (approximately 182 days), the interest is prorated, and the minimum interest is only equivalent to one week’s interest.

To reduce the volatility of GRAI, a redemption mechanism similar to Liquity has been developed, allowing GRAI holders to exchange 1 GRAI for $0.97 worth of collateral, incurring a purchase fee practically. 3% back.

Index Coop (dsETH)

Index Coop is a DAO-managed protocol that primarily provides users with structured DeFi products and strategic tokens.

With the current evolution of the LSD and LST protocols, Index Coop offers ETH holders two index tokens to simplify the earning process: ETH Diversity Staking Index ($dsETH) and Compound ETH Index ($icETH).

With more and more LSD protocols appearing, it is difficult for some bettors to choose in terms of profits. Since these LSD and LST protocols are based on the Ethereum mainnet, it can be expensive to deposit ETH into multiple LSD protocols or buy multiple LSTs from the secondary market to diversify investments.

Index Coop addresses this difficulty by pooling popular LST into a single ERC20 token, dsETH.

Conclusion

Above are our shares about LSDFi and outstanding LSDFi projects. In a nutshell, the LSDFi protocol’s one-day historical cash flow of $25 million, with Lybra Finance leading the charge with a cash flow of $24 million, is a testament to the platform’s growing importance in the DeFi space. With a diverse range of participants and a robust Total Locked Value, LSDFi is poised to shape the future of decentralized finance, providing users with a powerful tool to optimize farming strategies and their productivity.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.